Too many business owners are sitting on a debit card or using a low-value business credit card. This is because they don’t know any better. It’s time to get rewarded for your spending. Don’t miss out! Start with $750 – $1,000 in cash with Chase Ink Business Credit Cards. These three cards are some of the top-ranked cards on CashFreely. Spend 5-10 minutes to open up a new business card and start racking up the free money.

Don’t be fooled by other cards with large sign-up bonuses. Not all credit card rewards are equal. Points (which can be converted to straight cash back) from Chase business cards are the best in the eyes of most CashFreely users. They are highly valued compared to other programs.

Looking for instructions on how to apply for a business credit card? Click here to skip down below for step-by-step instructions.

The Chase Ink Business Preferred® and its excellent bonus with lower spending requirements. Amazing news for those who love lots of cash back.

Chase Ink Business Cash® – $750 cash back

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

Important Update on Eligibility (November 2025): Chase has introduced pop-up language for the no-annual-fee Chase Ink Business Unlimited® Credit Card and Chase Ink Business Cash® Credit Card, making welcome bonus eligibility a bit less predictable. The bonus may not be available if you have previously received a bonus on either the Ink Business Cash OR the Ink Business Unlimited, and the good news is that you should get a pop-up to let you know if you’re not eligible before a hard credit check.

Out of the three Chase business cards, this card has an incredible signup bonus for a no-fee card.

- Earn 5% cash back (on first $25k spent) for phone, TV, internet, and office supply stores.

- Earn 2% cash back on gas and restaurants

- Great option for carrying a balance

- No Annual Fee

Chase Ink Business Unlimited® – $750 cash back

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Important Update on Eligibility (November 2025): Chase has introduced pop-up language for the no-annual-fee Chase Ink Business Unlimited® Credit Card and Chase Ink Business Cash® Credit Card, making welcome bonus eligibility a bit less predictable. The bonus may not be available if you have previously received a bonus on either the Ink Business Cash OR the Ink Business Unlimited, and the good news is that you should get a pop-up to let you know if you’re not eligible before a hard credit check.

An all-around great cash-back Chase business card with no annual fee. It’s very simple. You earn unlimited 1.5% cash back per $1 spent on all purchases using your Chase Ink Business Unlimited. Furthermore, it is great for carrying a balance. This is a popular standalone card among the Chase Business Ink cards.

- Earn 1.5% cash back on everything

- Great for carrying a balance

- No Annual Fee

Chase Ink Business Preferred® – 100,000 Points, which is worth $1,000 cash back

A highly recommended business card for its signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

New Eligibility Rules of as November 2025: The new cardmember bonus may not be available to you if you have previously had this card. Chase may also consider factors pertinent to your business in determining your bonus eligibility.

The Chase Ink Business Preferred card has a great sign-up bonus and 3X categories. Additionally, this all-around business card has flexible redemption options — whether you want cash back or travel reward points. Also, it can be combined with your personal Chase Ultimate Rewards points.

- Earns 3x points on travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) — convert your points into cash back, and that means you are earning 3% cash on these purchases

- Points worth 25% more when redeemed for travel — our sister site Travel Freely includes information on how these business cards can be redeemed for travel

- Cell phone protection against theft or damage

- No foreign transaction fees

Comparing the three Chase Ink cards

| Card | Sign-up Bonus | Spending Required | Annual Fee |

|---|---|---|---|

| Ink Cash | $750 cash back | $6,000 in first 3 months | $0 |

| Ink Unlimited | $750 cash back | $6,000 in first 3 months | $0 |

| Ink Preferred | $1,000 cash back | $8,000 in first 3 months | $95 |

How to Apply

Click through below to move forward with a certain card. It is also important to know whether you are eligible to apply or not.

Tell Chase about your business

The first part of the application is about your business. Your answers should be straightforward if you already have a well-established business. But if you are just starting, below are some examples of how to fill this out, assuming you do not have any employees. Then, you operate as a sole proprietorship (which is the most basic form of a business) if you do not have a Tax ID. If the examples given don’t match your circumstances, use your judgment to answer differently:

Business Information

- Legal Name of Business: Use your name as the business name if you don’t have a business name.

- Business Name on Card: Again, use your name as the business name if you don’t have a business name.

- Business Mailing Address: Your home address can be used if you don’t have a separate business address.

- Type of business: Sole Proprietor

- Tax Identification Number: This can be your SSN, but you can also create an EIN for your business (found here)

- Business category/type/subtype: Pick whichever categories are closest to your business

- Number of Employees: 0 (you)

- Annual Business Revenue: 0 (or project an amount based on monthly revenue to date)

- Years in Business: (number of years you’ve been operating the business with or without revenue)

Personal Information

This part of the application is all about you personally:

- Authorizing Officer: Owner

- Gross annual income: Include all of your income and not just business income

- The rest should be self-explanatory

How to improve your chances of success

The following tips can help with approval, but none are guaranteed:

- Use an EIN instead of your SSN when entering your Business Tax ID on the application

- Do not call if your application goes to pending

- Call if your application is denied

Do not call if your application goes to pending

When applications go to pending, people frequently find that they get approved without calling. But when people do call, they often get tough analysts who deny the application.

The approval process goes through up to 3 “gates”:

- Instant Approval (this is rare with Ink business cards)

- Automatic Approval, sent by mail (may take several weeks)

- Analyst Phone Approval

If you’re not instantly approved, then calling bypasses gate 2. Doing this may reduce your overall chance of approval. So I recommend waiting to get a letter in the mail. Hopefully, it will say “congratulations”.

Of course, if Chase contacts you asking for more information, then you absolutely should talk to them on the phone. In some cases, they may simply need more information about you or your business before your application can go through the next review stage.

Call if you are denied (and call again)

If your application is outright denied (either instantly or by mail), then call Chase’s business reconsideration number, which is open Monday through Friday during business hours. There are many cases where analysts have overturned denials over the phone. If denied, call reconsideration at 1-888-270-2127 for business cards.

The analyst will likely ask a lot of questions. Make sure your answers match your application. Also, if you have multiple Chase business cards, make sure to let the analyst know that you don’t need Chase to extend you more credit. Tell them that you are willing to move available credit from another card or cancel another card if necessary. Be prepared to answer financial questions about your business, why you want the card, and how you expect to use it. There is absolutely nothing wrong with saying that you were attracted by the signup bonus and by the 5% cash back spend categories (for example).

If the analyst doesn’t approve your application, call again. Many people have had luck simply calling a few times until they reached an analyst willing to take a chance on their business.

Any questions? Feel free to ask in the comments below or email us at letstalk at cashfreely.net.

Get to Know Chase Ultimate Rewards

Chase Ultimate Rewards points are valuable and flexible. At the simplest level, you can redeem points for cash or merchandise at one cent per point. However, Chase Ultimate Reward cards that charge an annual fee allow you to redeem points for travel, either through Chase’s Travel portal or by transferring them to an airline or hotel program. While you might care more about earning cash back right now, if the time arises when you prefer to redeem points — at typically a higher value — you can do that with these Chase Ink business cards. With the no-annual-fee cards, you’ll also have to have a premium card (one that charges an annual fee) to combine points and then redeem your points for travel. Our sister site, Travel Freely, offers a guide that explains more on how to maximize your Chase Ultimate Reward points if travel becomes an interest down the line.

Best Strategies by Business Type

Large businesses or owners of multiple businesses

It may be worth having two of these cards if your business spends a lot of money in certain categories. For example, you would obviously want the Ink Business Preferred for the large sign-up bonus and great ongoing benefits like 3x (worth 3% cash back) categories with monthly spending. Then, you could pair it with the Ink Business Cash and utilize the 5% categories for specific monthly spending.

Owners of multiple businesses

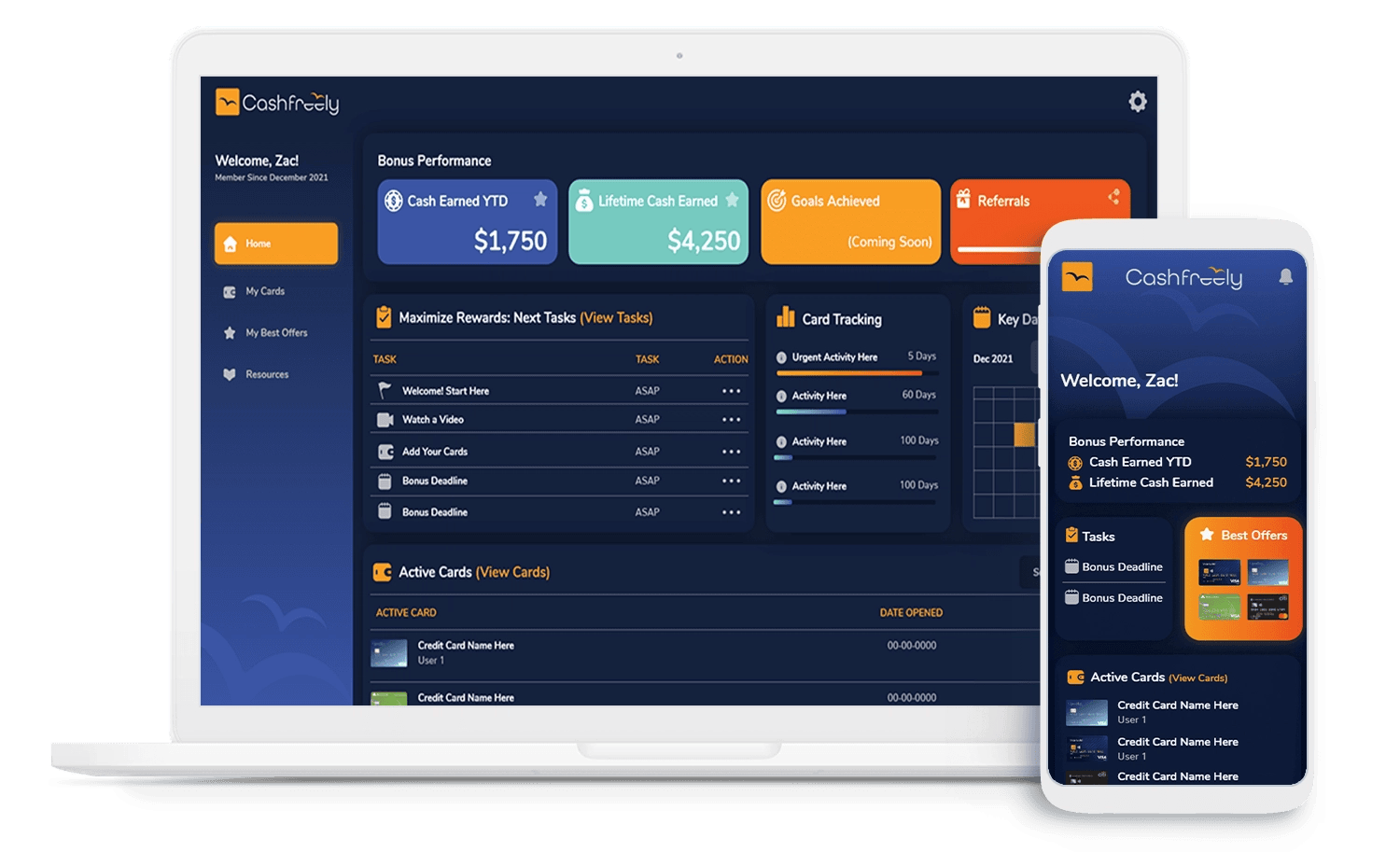

You can get more than one of these cards if you have multiple EINs or a spouse who can apply for an additional card using her SSN. You may also want to take a look at your monthly spending and see if you could benefit by having separate business cards for each business. One of our members has 6 LLCs and got six Ink Preferred cards this year. Tip: Use CashFreely’s app to automate your card management.

Very small or side business owners

Yes, you have a business. It’s common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning a rental property, renting on Airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.

The best option for a small business may be the Ink Cash or Ink Unlimited because of the lower spending requirement to hit a bonus (and no annual fee).

Sole Proprietors

When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business address and phone, and your social security number as the business Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

A highly recommended business card for its signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

Common Questions:

Can I put personal spending on business cards?

This is fairly common. While it’s good practice to separate business and personal spending, and banks may dissuade you from doing this, it isn’t illegal and many people do this.

What are the rules on getting more than one of these cards?

These Chase business cards are all treated as separate cards. You can apply and get approved for more than one. Keep in mind that Chase only allows you to apply and be approved for 2 cards (2 personal, 2 business, or 1 personal + 1 business) per 30 days. Also, people have reported issues when trying to apply for two cards on the same day. So it’s better to space out the applications by a few days.

If I have a personal Chase card like the Chase Sapphire Preferred or Chase Sapphire Reserve, can I transfer the points I earn on my business card to my personal card?

Absolutely. You can transfer points to other Chase accounts you have or those who are household members or authorized users. Here’s a walkthrough on how to Chase merge points.

Do these cards count towards 5/24?

You know that the Chase 5/24 rule is important when you are going to sign up if you have gotten several cards in the last 2 years. You must be under 5/24 to be approved. However, compared to personal cards, these Chase cards do NOT count towards your 5/24 count.

Any questions? Feel free to ask in the comments below or email us at ten.y1773175474leerf1773175474hsac@1773175474klats1773175474tel1773175474.

One thought on “Great Offers on Chase Business Cards”

Comments are closed.