If you’ve never heard of credit card rewards, WELCOME! Credit card rewards is a concept that more and more people are discovering. Lately, professional financial experts and the mainstream media are jumping on board. However, it’s only for certain people: those who are committed to good credit scores and know they will pay bills on time.

The bottom line: There is free money out there if you are a financially responsible person.

Signup Bonuses Are HUGE DEALS

Sign up bonuses are the BEST way to earn a crazy amount of cash back without spending a lot of money. A signup bonus is when a bank offers a special bonus if you spend a certain amount of money in the first few months of signing up for that card. This is how CashFreely users earn 80% of their cash back, through very lucrative signup bonuses.

These bonuses can range from $50 – $1,500 worth of credit card rewards, which can equal cash back. The spending requirements for the best bonuses can range from $500 to $5,000. Most spending requirements must be met in the first three months of opening an account. Some cards now have multi-tiered bonuses where additional spending will earn an additional bonus.

The average person can meet these minimum spending requirements with their regular monthly spending. That’s the beauty of this whole hobby. NO extra money spent, but thousands of $$$$ back in your wallet. In addition to signup bonuses, using your card for all your regular expenses is one of the simplest ways to earn cash back. If you trust yourself to spend only money you have, then it makes no difference whether the money comes out of your checking account when you swipe your debit card, or when you pay off your credit card at the end of the month. You might as well be earning cash back on your purchases. So, put all your regular spending on a credit card and watch the cash back add up.

Here’s why a signup bonus is so special.

Let’s do the math.

Cardmember #1 – Ignorant Izzy doesn’t even have a credit card that earns credit card rewards. She uses a debit card for all purchases, including gas, dining out and groceries.

Total Cash Back earned = $0

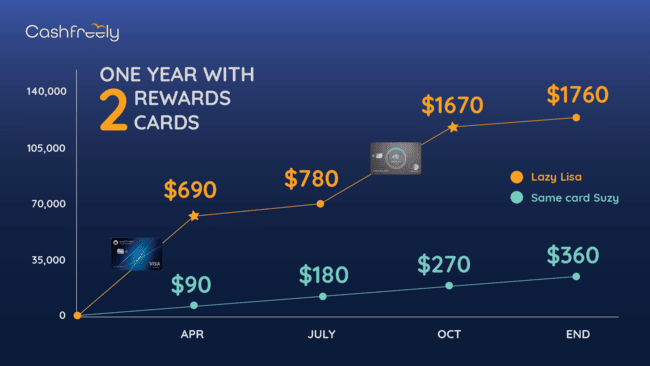

Cardmember #2 – Same Card Susie has one credit card which earns her cash back. She’s had it for 5 years and uses it to earn cash back on all purchases. She averages $1,500 per month of expenses. She earns 2% cash back on her card.

At the end of just one year, she earns $360 in cash back.

Cardmember #3 – Lazy Lisa knows the power of signup bonuses. Over 12 months, she gets two new cards with great bonuses to supercharge her cash back earning on her regular monthly spending. She averages $1,500 per month of expenses. She earns $600 and $800 bonus cash back due to signup offers on top of the 2% cash back she’s earning.

At the end of just one year, she earns $1,760 in cash back.

Here’s a Simple 1-2-3 Plan for a Beginner

CashFreely Members average $500+ in cash back with their first card bonus. Business owners average $750. You can be increasing your bank account in as little as 3-4 months.

First of all, sign up for CashFreely (for free) to access the Get Started Guide.

1. APPLY – Get ONE great card from your Best Offers Recommendations.

2. EARN – Put all your regular spending on the card and hit your bonus.

3. MAXIMIZE – Use our Resources page and free guides to increase your cash back in just one year

Just want a list of the best cards? Here are our best monthly offers and our list of overall card recommendations.

How Is This Possible?

Banks make some of their biggest profits through credit cards. Unfortunately, many people carry balances on their cards, and the banks get rich through charging interest. An estimated 38% of households pay an average of $1,250 per year in interest. So, banks are more than willing to offer up cards with big signup bonuses in order to capture new customers.

If you are paying your cards off every month, there is a life of credit card bonuses waiting for you. To be able to maximize your rewards, you’ll need to understand the power of credit and to maximize these offers so you can start increasing your bank account and increasing your budget.

Two Important Points

Credit Scores Increase

Most people see their credit score increase when they open up new credit cards. The reason for this has to do with the facts and myths about how a credit score is calculated. When you sign up for more cards and prove to be responsible with them, you are improving most of the major credit score factors like total accounts and credit utilization. Read more about that here.

Banks are only losing a few dollars and making billions

In April of 2018, news stories were reporting how JP Morgan Chase had been losing millions in rewards given out from credit cards. What was missed in those headlines was the real headline: “JP Morgan reports its most profitable quarter ever.” How did they make their profits? The bank’s credit card business was “one of the biggest drivers of growth, with revenue from plastic jumping 39 percent to $1.28 billion.”

Here’s one more quote from a Federal Reserve report in 2017, “Credit cards remain far more profitable than other types of banking.” Almost 40% of American households pay credit card interest because they carry a balance. Since they are paying an average of $1,254 per year, the banks are not that concerned with a few people making $500-700 every once in a while. In fact, the average person uses a particular credit card for 7 years.

So if 40% of new users get a $500 bonus and end up paying $1,254 per year for 7 years, the bank ends up making $8,278 over 7 years. Don’t forget that they make 2-3% of every purchase you make too. This is why if you don’t trust yourself with credit cards, you need to run away right now. Otherwise, your key to the credit card rewards treasure is: your credit.

Be a Transactor

In credit card terms, there are transactors and revolvers. “Transactors” use their cards for purchases and pay off the balances each month. ”Revolvers” carry balances on their cards, paying interest charges month to month. A transactor does not see the balances on their cards as debts because the charges are paid off in full every month. They don’t pay any interest. So, smart cash backers are TRANSACTORS. They are financially responsible people who pay their bills on time. They outsmart this unfortunate cycle of debit that allow banks to make large profits.

Slow and Steady is the Simplest Way to CashFreely

Jumping into the world of credit cards and signup bonuses can be intimidating to some people, especially those who are brand new to credit card rewards and are a bit suspicious. Nothing in life can be free, right? Well, this is one of those rare cases because so many other people carry a balance on their cards. The banks are fine with giving away big bonuses because a large amount of people end up paying enormous fees in interest (and they still charge merchants 2-3% on every swipe.).

I suggest signing up for CashFreely so you have a proven system to get the best cards and automate your card management. It’s worth reading a few articles to address your concerns and give you the confidence to sign up for a credit card. I’ll warn you, it’s a bit like watching the movie The Matrix. Once you realize what’s happening and how much money you are earning, you can’t go back. You’ll be hooked.