The Chase Freedom® Unlimited card is a great choice for beginners due to it’s no annual fee, easy to earn structure and flexible redemption options.

The Freedom Unlimited card is unique among Chase’s Ultimate Rewards cards in that you’ll earn a minimum of 1.5% cash back on all spend while also earning 3% to 5% cash back within specific bonus categories. Chase advertises the Freedom Unlimited as a cash back card, but it actually earns Chase Travel points — which you’ll then need to redeem for cash.

This card does charge foreign transaction fees, so be sure to use a different card when traveling internationally. Within the US though, the Freedom Unlimited is an excellent choice both for its category bonuses and as an “everywhere else” card which earns a minimum of 1.5% cash back.

Table of Contents

Should you apply?

The Freedom Unlimited is a good choice in many cases. You can use the Freedom Unlimited to earn 5% cash back for travel booked through Chase Travel, 3% cash back for drugstores and dining, and 1.5% cash back on all other spend.

And, if down the line, you’d prefer to use your rewards earned towards travel, you can do that too when paired with a premium card, such as the Chase Sapphire Preferred® and Chase Sapphire Reserve®. The benefit is that your points are worth much more — at least 1.25 cents per point if moved to the Sapphire Preferred and at least 1.5 cents per point if moved to the Sapphire Reserve. You can learn more about redeeming your points towards travel at our sister site, Travel Freely.

Are you eligible?

To apply for the Freedom Unlimited card, you must not currently have the same card (it’s okay to have a different Freedom card), and you must not have received a welcome bonus for the Freedom Unlimited in the past 24 months.

Additionally, to get this card you must be under 5/24.

How to apply

You can find the current best welcome bonus offer and application link at the top of this page: Chase Freedom Unlimited.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, call for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Freedom Unlimited Perks

Travel Protection

- Auto Rental Coverage: Chase offers secondary auto rental CDW (collision damage waiver) when renting within your country of residence (presumably it is primary for rentals in other countries).

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.”

Chase Freedom Unlimited Earn Points

Welcome Bonus

The welcome bonus for this card is advertised as cash back, although you’ll earn ‘points’ which you’ll then need to redeem for cash. Here’s the current offer:

With this card, you typically earn 3% cash back on dining (including takeout and select delivery services), 3% cash back on drugstores, 5% cash back on travel purchased through Chase Travel℠, and 1.5% cash back on everything else.

Chase Freedom Unlimited Redeem Points

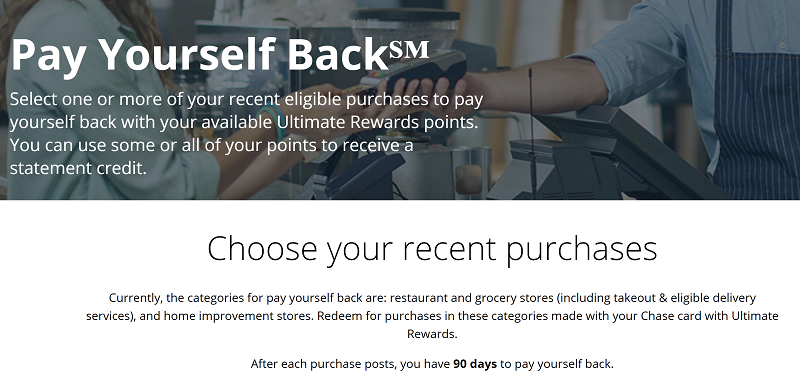

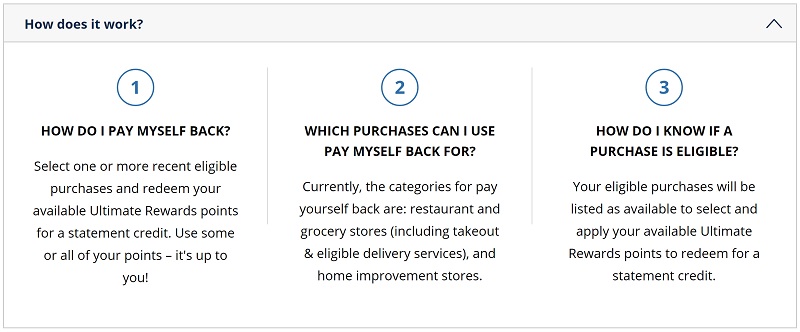

Pay Yourself Back

Cash Back

Cardholders can cash out points for 1 cent each. Cash back can be taken as a statement credit, check, or ACH transfer.

Other ways to redeem points

Chase Freedom Unlimited Manage Points

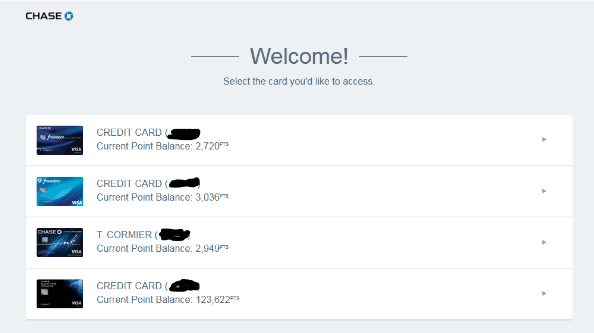

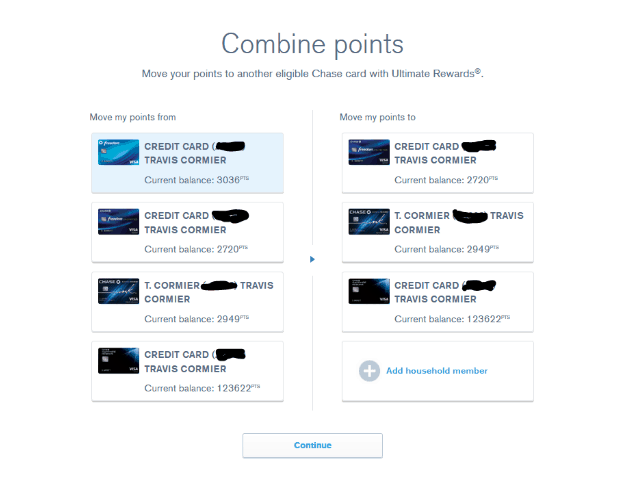

Combine Points Across Cards

Share Points Across Cardholders

This is value if another family member has a higher redemption card when it comes to paying yourself back with the redemption tool. Or, if one day you want to redeem your points for travel instead of cash back.

Transfer difficulties? Create a loop

If you have trouble transferring between accounts, some users have been able to combine points between their own accounts — like from Bob’s Ink Business Cash to Bob’s Sapphire Reserve — via secure message.

For example, let’s say that Joe and Suzy live in the same household and are joint owners of a business and have the following accounts:

- Chase Freedom Unlimited (Joe)

- Chase Ink Business Cash (Joe)

- Chase Sapphire Reserve (Suzy)

First, Joe combines points from his Freedom Unlimited to Suzy’s Sapphire Reserve. Later, he logs into his Ink Business Cash account and tries to combine points with Suzy’s Sapphire Reserve. Joe may run into an error adding Suzy’s Sapphire Reserve card to combine points. This has happened in our household several times. In that case, Joe should log into his Freedom Unlimited account and remove Suzy as a household member (click “remove saved card). About 24 hours later, he should be able to add Suzy to his Ink Business Cash in order to combine his points to her account.

How to Keep Points Alive

Chase Freedom Unlimited Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

Is this card worth keeping in the long run? Yep. With no annual fee and strong earning power, why not? If you decide to cancel anyway, make sure to first redeem any remaining points or move them to another Ultimate Rewards card.

Related Cards

Ultimate Rewards Consumer Cards

A very strong card that is super flexible for cash back or free travel. Lots of good spending categories and the ability to move points to a premium Chase Ultimate Rewards® card makes this a great card to have.

With this card, you typically earn 3% cash back on dining (including takeout and select delivery services), 3% cash back on drugstores, 5% cash back on travel purchased through Chase Travel℠, and 1.5% cash back on everything else.

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Increased Offer! Elevated offer on a completely refreshed card loaded with perks and benefits. Note the large annual fee.

Ultimate Rewards Business Cards

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

A highly recommended business card for its signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.