Chase Ultimate Rewards is a best-in-class program. There are multiple personal cards and business cards that earn Chase Ultimate Rewards. Best of all for CashFreely fans, it is easy to redeem Chase Ultimate Reward points for cash back.

Chase Ultimate Rewards are one of our absolute favorite “secret” cash back programs.

Below, you’ll find everything you need to know about Ultimate Rewards.

Earn Points

With Chase Ultimate Reward cards you are earning points, but if you choose to redeem your points for cash back, you are redeeming at a rate of 1 point = 1 cent. So when we are talking about earning points, you can think of it as a cash back percentage instead.

Credit Cards

The easiest and quickest way to earn Ultimate Rewards points is through Chase credit card signup bonuses, category bonuses, and retention offers (though Chase is not known for generous or frequent retention offers). Below are the current Chase cards that earn Ultimate Rewards.

Many cards also offer bonus offers for particular spend categories. Some of the higher ones — that earn between 3x (3% cash back equivalent) to 5x (5% cash back) rewards include:

Personal Cards:

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Increased Offer! Elevated offer on a completely refreshed card loaded with perks and benefits. Note the large annual fee.

With this card, you typically earn 3% cash back on dining (including takeout and select delivery services), 3% cash back on drugstores, 5% cash back on travel purchased through Chase Travel℠, and 1.5% cash back on everything else.

A very strong card that is super flexible for cash back or free travel. Lots of good spending categories and the ability to move points to a premium Chase Ultimate Rewards® card makes this a great card to have.

Business Cards:

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

A highly recommended business card for its signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

Redeem Points

Starting your journey with credit card rewards and maximizing your cash back is an awesome experience. Most beginners choose wisely and start with a Chase Sapphire Preferred card. The feeling when your first bonus hits is what really proves that this works.

Here we will go through how to redeem for cash back with the points earned. (Note: If you are interested in redeeming travel with your Chase Ultimate Reward points instead, you can visit our sister site at Travel Freely to learn more.)

Cash Back and Gift Cards

Chase Ultimate Rewards cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer. You can also elect to get gift cards.

Pay Yourself Back

Chase allows you to redeem your points for certain category purchases with their “Pay Yourself Back” tool. If you make a purchase that qualifies, you can redeem your points at an increased rate on select categories that rotate throughout the year.

Manage Points

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can combine Ultimate Rewards back and forth between your accounts at your leisure. Your points can then be redeemed according to the card to which you move them.

For example, you have the Chase Freedom Unlimited card — due to their great cash back opportunities where you earn 1.5% cash back on all non-category bonus purchases — but, down the line you decide you want to instead redeem your points for travel. You can then apply for the Chase Sapphire Reserve card and transfer your Freedom Unlimited points to your Sapphire Reserve account. From there, those points earned with the Freedom Unlimited can be redeemed for more value towards travel through the Sapphire Reserve account.

If you intend to cancel a Chase Ultimate Rewards card, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Step-by-Step Instructions:

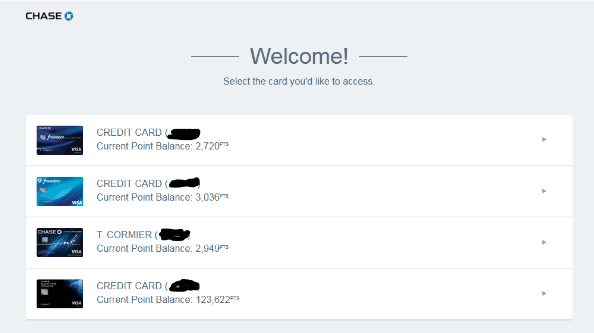

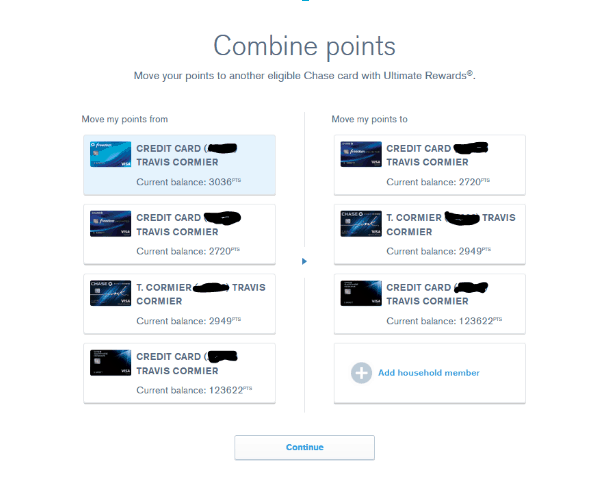

First, you’ll want to log into your portal. Here you’ll see all your Ultimate Rewards cards laid out. As you can see in the example below, not all of my points are together on my Chase Sapphire Reserve. I want to combine Chase Ultimate Rewards onto my Reserve to get the best value.

Select the card you want to move points from. In this example, I’ll use my Chase Freedom.

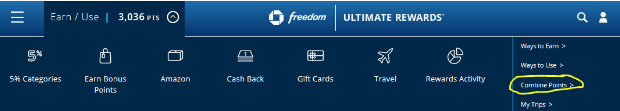

At the top menu, you’ll see in the small text the option to combine points. Click this.

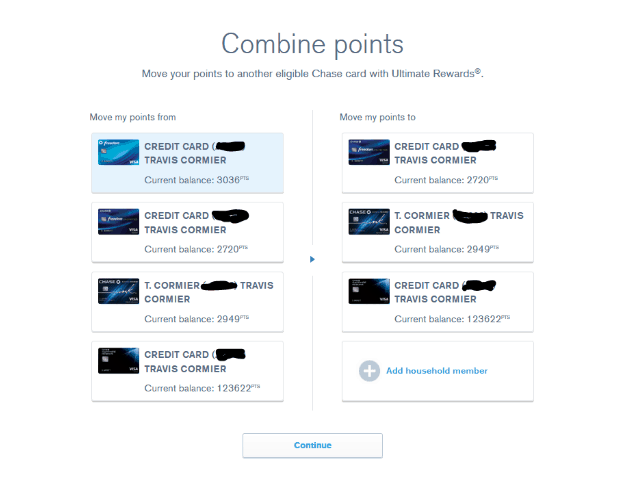

This will take you to the page to combine your points. Here you can combine Chase Ultimate Rewards from any card, to any card. Select the cards you want to combine from and to, and click continue.

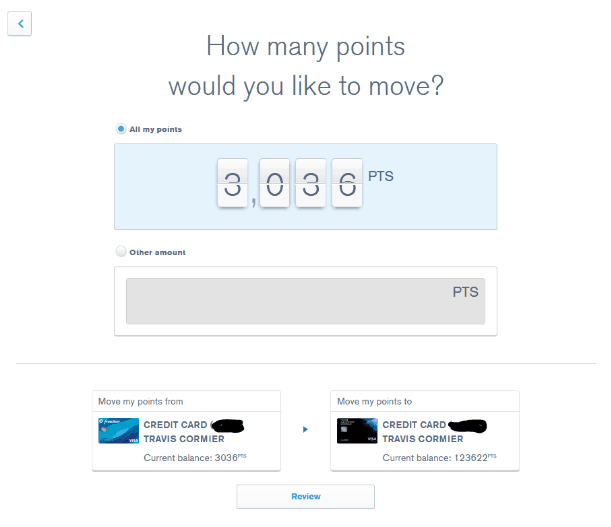

You can transfer partial or total amounts. Select the amount you want to combine and click review, then confirm and submit.

That’s all there is to combine Chase Ultimate Rewards between your own accounts

Share Points Across Cardholders

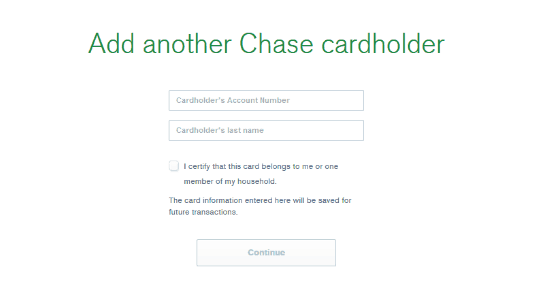

Chase allows customers to transfer Ultimate Rewards points to any other account in that customer’s name or to one additional household member or joint business owner (for free).

When you do this, you’ll just need to enter your spouse or cardholder’s name and account number. The account number is just the credit card number of the account you are transferring points to.

After that, you will just need to confirm the amount you wish to transfer. Then you will be able to combine Chase Ultimate Rewards between household accounts.

This is valuable if someday down the road you decide you prefer to redeem your points towards travel versus cash back. This is because you can be strategic by earning points with the card offering the best return on purchases and then using points with the card offering the best redemption rate.

How to Keep Points Alive

Thankfully, it is very easy to keep Chase Ultimate Rewards points alive: simply keep the points in an open Ultimate Rewards account and they will not expire. Note that if you close an Ultimate Rewards card, you will lose any points associated with that card. You should first redeem your points for cash back because canceling the card. Or, if you aren’t ready to redeem your points at the time, you can always move points away from the card you intend to close and to another card that will remain open as per the sharing section above before canceling.

More information

Chase’s official Ultimate Rewards page can be found here.

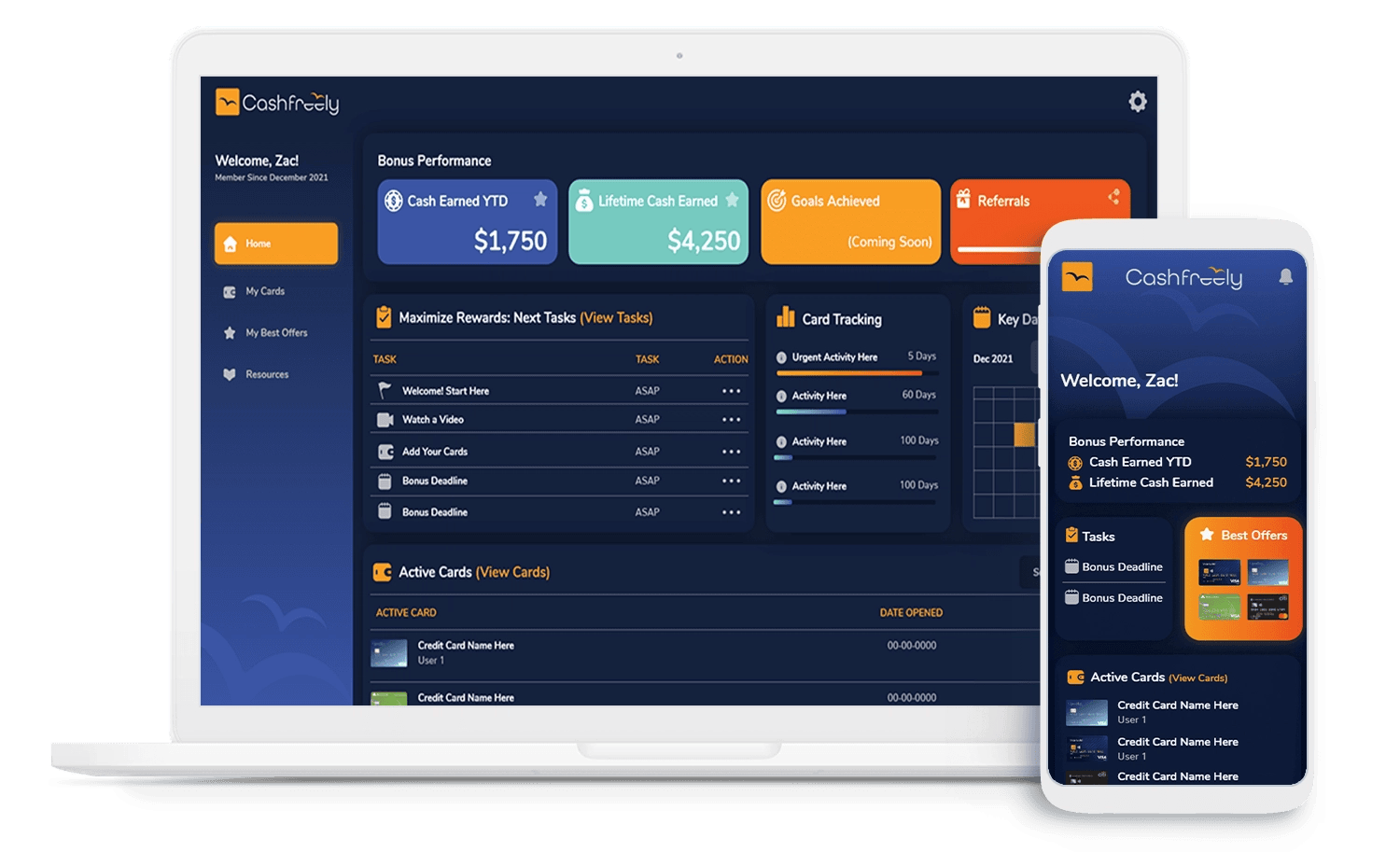

When you sign up for the CashFreely, you’ll unlock immediate access to our CashFreely Guide to help you get started.

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Related Articles:

https://cashfreely.net/6-reasons-why-we-love-the-chase-sapphire-preferred-card/