CashFreely is all about maximizing your cash back in the easiest way possible. So, start here with the Chase Sapphire Preferred card. It’s the easiest recommendation for beginners who are getting started with the best rewards credit card. It’s been around for a while, and it’s always at the top of the “best cards” lists. Why? Chase Ultimate Rewards points are easy to use and flexible — and best of all, points can be easily be redeemed for cash back.

Our #1 personal card that we recommend most often. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility. For those looking for cash back, 60,000 Chase Ultimate Reward points can redeemed for $600 cash back.

Here are some great reasons to love the “CSP.”

1) Welcome offer is worth a minimum $600 in cash back

When you hit your minimum spending bonus, you’ll get 60,000 Chase Ultimate Rewards points. While these points can be redeemed in many different ways, one option is for straight cash back. With 1 point equaling $0.01 cash back, the 60,000 points earned can be redeemed for an easy $600.

Now, you don’t have to redeem your points for cash right away, if you think you might prefer to use them for travel at a future time. You can always hold onto your points — they don’t expire as long as the card is kept open — and then determine whether you prefer to convert the points earned into cash, gift cards, travel, etc.

If you are interested in travel rewards, you can visit our sister site, Travel Freely, to learn more about how the points earned from this card can be put towards travel. With points earned from this card, they are worth a minimum of 25% more when used towards travel.

2) It’s EASY to redeem

Cash Back with the Chase Sapphire Preferred

Chase Ultimate Rewards points are a great option for cash back. If you’re looking for a card that gives you better earning opportunities by way of cash back, then the Chase Sapphire Preferred is a great card for you.

With a redemption rate of 1 point = 1 cent, you can easily convert 60,000 Chase Points to $600 cash for anything you want to spend on. Check out the graphic below to see how your Chase Sapphire Preferred Card performs against other cards in terms of cash back.

Check out this article if you’re interested to learn more about our best Cash Back cards.

Chase offers a “Pay Yourself Back” option where, as of January 2023, Chase Sapphire Preferred holders can redeem points towards purchases with 1 point equalling 1 cent. Limited categories (e.g., certain charities) are worth 1.25 cents, which is a better value than straight cash back and can help offset some purchases you’re putting on your card anyway.

And of course, you can always redeem your points towards travel if you find that you might prefer a vacation versus cash back at a certain time. Here you can book travel directly through the Chase Travel℠ portal where 1 point is worth 1.25 cents or you can transfer points to a loyalty travel partner (examples include Southwest, United, Hyatt, Marriott). You can learn more about redeeming your points for travel with our sister site, Travel Freely.

3. You can earn 3% in cash back value at restaurants

Beginners and advanced CashFreely members use the Chase Sapphire Preferred card. You earn 3x points (3% cash back equivalent) on all dining. Any travel purchases, such as hotels, airfare and car rentals will earn you double points, so 2% cash back.

Even things like taking an Uber or paying for parking will get 2x points (2% cash back), too. But, if you happen to make any travel purchases through Chase Ultimate Rewards, you’ll earn 5x points (5% cash back).

4. You get some great travel perks.

No foreign transaction fees can prove to garner big time savings for beginners who would otherwise use debit cards or cash. Credit cards often get the best exchange rate abroad, and you don’t even have to worry about carrying around extra cash.

Primary car rental insurance is also covered when you pay for your rental car with this card. Waive the fee and save $10-15 per day.

$50 hotel credit where you’ll receive $50 in statement credits each account anniversary year for hotel stays purchased through Ultimate Rewards.

Other benefits include trip delay, trip cancellation, and baggage delay insurance. These benefits alone could be super helpful right when you need them.

With the Chase Sapphire Preferred card, you’ll have primary car insurance in addition to no foreign transaction fees.

5. The 5/24 Rule

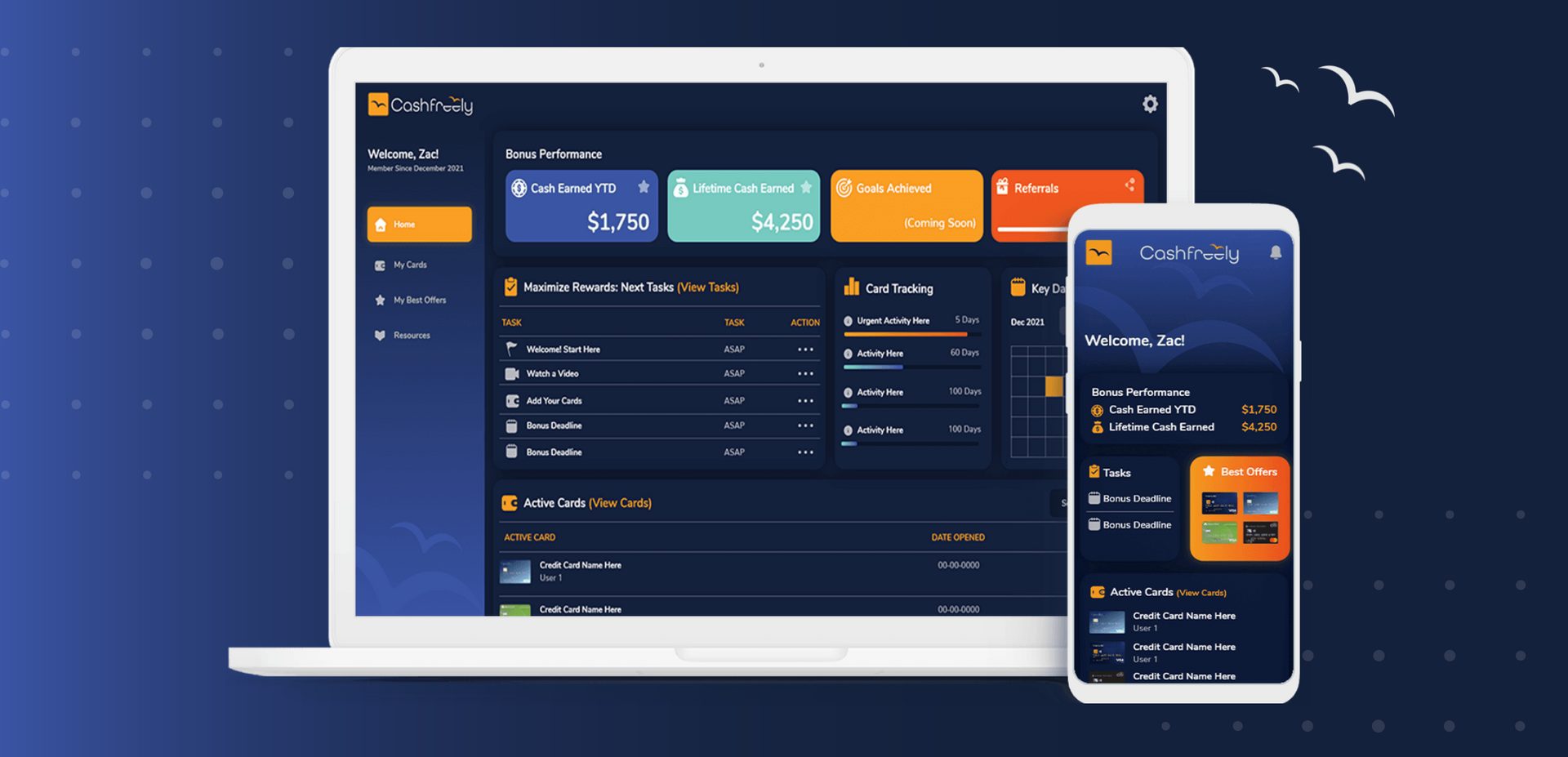

Beginners may not realize that Chase has an “unofficial” rule of denying credit card applications if someone has opened 5 cards in the previous 24 months. Some cards don’t count towards this, but most personal cards do. The CashFreely site has a 5/24 counter on your dashboard. This is a game-changer. So, when you are starting out with rewards cards, you need to get this card sooner than later. The Chase Sapphire Preferred is subject to the 5/24 rule, so you want to make sure you get it before some of the other great cards.

A screenshot of the CashFreely’s card dashboard. The 5/24 counter (top right) is a HUGE deal as you start to rack up more rewards.

So what’s the best starter cash back? This is it. No question about it.

Our #1 personal card that we recommend most often. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility. For those looking for cash back, 60,000 Chase Ultimate Reward points can redeemed for $600 cash back.

For the reasons above, sign up for the Chase Sapphire Preferred.