The Chase Freedom® Unlimited card is a great choice for beginners due to it’s no annual fee, easy to earn structure and flexible redemption options.

The Freedom Unlimited card is unique among Chase’s Ultimate Rewards cards in that you’ll earn a minimum of 1.5% cash back on all spend while also earning 3% to 5% cash back within specific bonus categories. Chase advertises the Freedom Unlimited as a cash back card, but it actually earns Ultimate Rewards points — which you’ll then need to redeem for cash.

This card does charge foreign transaction fees, so be sure to use a different card when traveling internationally. Within the US though, the Freedom Unlimited is an excellent choice both for its category bonuses and as an “everywhere else” card which earns a minimum of 1.5% cash back.

Should you apply?

The Freedom Unlimited is a good choice in many cases. You can use the Freedom Unlimited to earn 5% cash back for travel booked through the Chase Travel℠ Portal, 3% cash back for drugstores and dining, and 1.5% cash back on all other spend.

And, if down the line, you’d prefer to use your rewards earned towards travel, you can do that too when paired with a premium card, such as the Chase Sapphire Preferred® and Chase Sapphire Reserve®. The benefit is that your points are worth more — if moved to the Sapphire Preferred or the Sapphire Reserve. You can learn more about redeeming your points towards travel at our sister site, Travel Freely.

To apply for the Freedom Unlimited card, you must not currently have the same card (it’s okay to have a different Freedom card), and you must not have received a welcome bonus for the Freedom Unlimited in the past 24 months.

Additionally, to get this card you must be under 5/24.

How to apply

You can find the current best welcome bonus offer and application link at the top of this page: Chase Freedom Unlimited.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, call for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Freedom Unlimited Perks

Travel Protection

- Auto Rental Coverage: Chase offers secondary auto rental CDW (collision damage waiver) when renting within your country of residence (presumably it is primary for rentals in other countries).

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.”

Chase Freedom Unlimited Earn Points

Welcome Bonus

The welcome bonus for this card is advertised as cash back, although you’ll earn ‘points’ which you’ll then need to redeem for cash. Here’s the current offer:

With this card, you typically earn 3x on dining (including takeout and select delivery services); 3x on drugstores; 5x on travel purchased through Chase Travel℠; and 1.5x on everything else.

Chase Freedom Unlimited Redeem Points

Cash Back

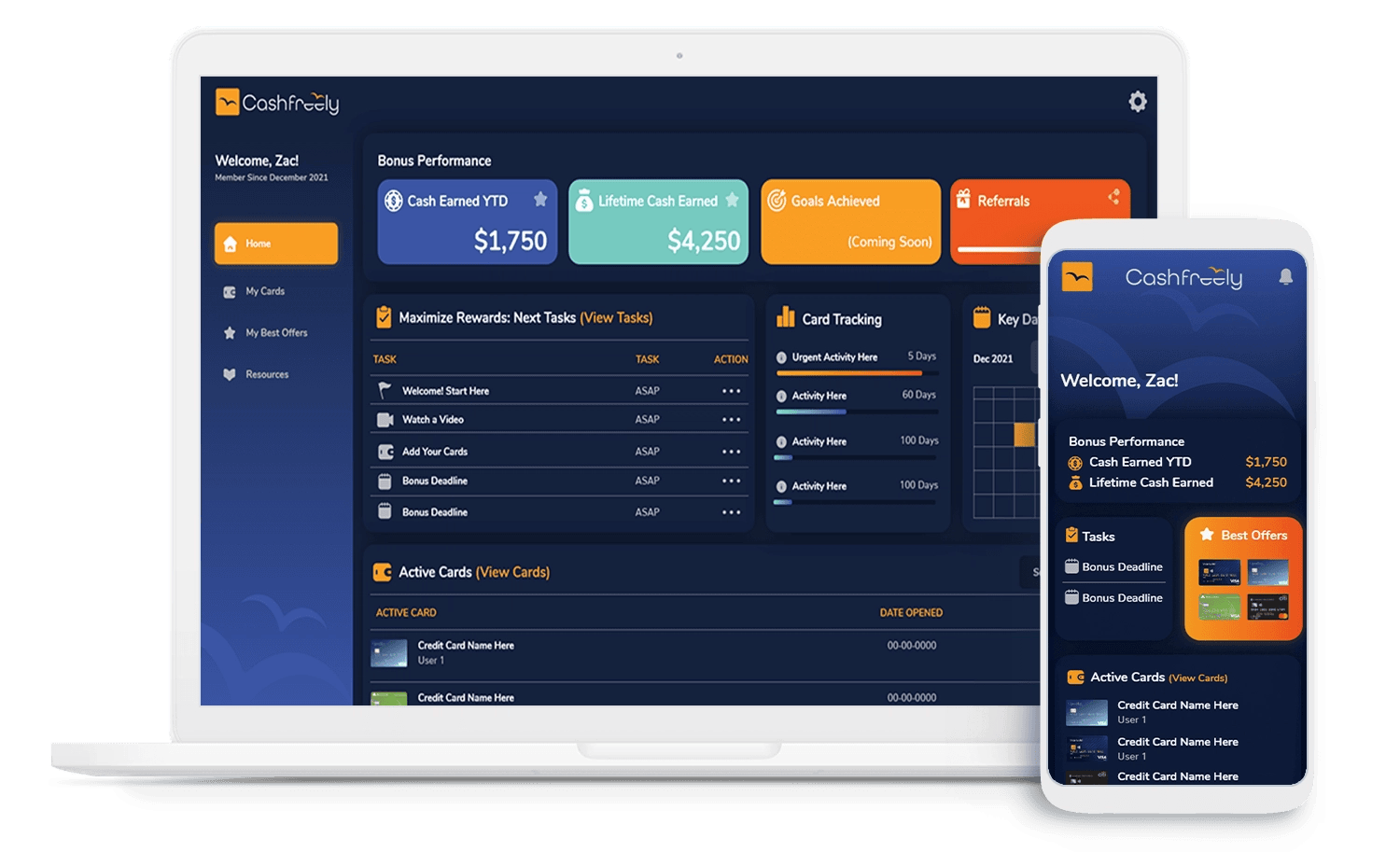

Cardholders can cash out points for 1 cent each. Cash back can be taken as a statement credit, check, or ACH transfer.

Other ways to redeem points

Through the Ultimate Rewards portal you can redeem points for cash back, gift cards, merchandise, or experiences. With this approach you’ll usually get 1 cent per point value. One exception is that Chase occasionally offers gift cards at a discount so you may be able to get better than 1 cent per point value during a gift card sale.

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don’t do this. These options offer very poor value. Additionally, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your Ultimate Rewards points – causing you a headache in getting your points reinstated).

Chase Freedom Unlimited Manage Points

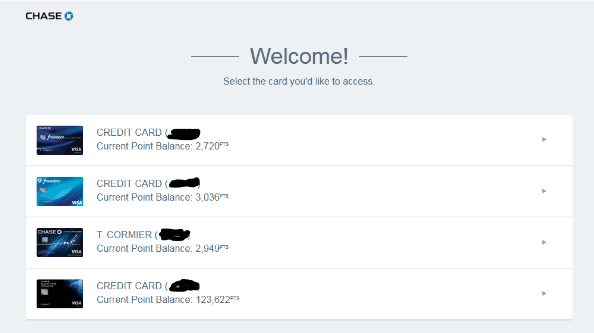

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can freely combine Ultimate Rewards back and forth between your accounts. Your points can then be redeemed according to the card to which you move them.

If you intend to cancel a Chase Ultimate Rewards card, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

Chase allows customers to transfer Ultimate Rewards points to any other account in that customer’s name or to one additional household member or joint business owner (for free).

This is valuable if another family member has a higher redemption card when it comes to paying yourself back with the redemption tool. Or, if one day you want to redeem your points for travel instead of cash back.

How to Keep Points Alive

Thankfully, it is very easy to keep Chase Ultimate Rewards points alive: simply keep the points in an open Ultimate Rewards account and they will not expire. Note that if you close an Ultimate Rewards card, you will lose any points associated with that card. You should first combine points to move points away from the card you intend to close and to another card that will remain open as per the sharing section above before canceling.

Chase Freedom Unlimited Lifecycle

How to meet minimum spend requirements

Once you are approved for a Chase card, you will have to meet the required spend in order to get the signup bonus. If your usual spend isn’t enough, consider using the Plastiq bill pay service to use your card to pay bills that can’t usually be paid by credit card (rent, mortgage, contractors, etc.).

Keep, cancel, or product change?

Is this card worth keeping in the long run? Yep. With no annual fee and strong earning power, why not? If you decide to cancel anyway, make sure to first redeem any remaining points or move them to another Ultimate Rewards card.

Related Cards

Ultimate Rewards Consumer Cards

A very strong card that is super flexible for cash back or free travel. Lots of good spending categories and the ability to move points to a premium Chase Ultimate Rewards® card makes this a great card to have.

With this card, you typically earn 3x on dining (including takeout and select delivery services); 3x on drugstores; 5x on travel purchased through Chase Travel℠; and 1.5x on everything else.

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility. Note: New application rules as of June 2025 may affect your eligibility—click to learn more before applying.

Great new offer! Completely refreshed and loaded with perks and benefits. Note the large annual fee. Note: New application rules as of June 2025 may affect your eligibility—click to learn more before applying.

Ultimate Rewards Business Cards

A highly recommended business card for signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.