At CashFreely, we are all about increasing our cash back. That means maximizing your sign-up bonuses. So there’s a strategic decision to be made when your annual fee is coming up.

We believe there’s a best strategy for these decisions in order to maximize your rewards and save on fees. Sometimes it makes sense to pay the fee, but most of the time we recommend canceling or changing your card to a no annual fee card.

Need a number? Scroll down to see customer service numbers.

You have three options:

1) Keep your card

2) Change your card

3) Cancel your card

1. Keep the card and pay the annual fee. Some cards are just worth keeping. This card is usually my all-the-time card when I’m not hitting a bonus. For example, the Chase Ultimate Rewards points that come with the Chase Sapphire Preferred card has some great flexibility. While you can redeem your points earned for valuable cash back, if you prefer to switch things up, the points can instead be redeemed towards travel with a range of redemption options.

2. Change the card to avoid the fee. Changing (or “downgrading”) is always the first option if you don’t want to pay the annual fee. Not all cards can be downgraded, but most can. To downgrade a card means that you are changing your card to a $0 annual fee card, or doing a “product change.”

This change is so good because it does not close your credit history for that account. It keeps your credit history tied to the original count, which is great. Note, doing a product change almost never counts as a “new account.” Starting mid-2021, some people have reported the Citi has counted some downgraded cards as new accounts. It’s always a good idea to double check with the bank to make sure a credit inquiry will not happen and that a new account will not be created.

Another big benefit to downgrading is that it works best for increasing your cash back in the future. Why? Because you can become eligible and re-apply for most of the big rewards cards you’ve already had. In many cases, you can sign up again for the same card and a new bonus every couple of years. So if you downgrade the card, you will no longer officially hold that card and you will be ready to become eligible for another big bonus down the road.

3. Cancel the card to avoid the fee. If you cannot make a change and want to avoid the annual fee, it’s a good idea to cancel as long as you have some long-standing $0 annual fee cards as the backbone of your credit score. Some people are concerned about their credit score. On average, if you have several cards, canceling a card will only temporarily drop your score by a few points.

Pro tip: If you want to cancel a card but have a big credit limit on that card, consider shifting that available credit over to another card you have with the same bank. Then cancel the card.

The main reasons I would keep a card would be:

How to change or cancel your card: It’s simple. Call the number on the back of your card. Let them know you’d like to downgrade (or cancel the card) because you don’t want to pay your annual fee. They may try to talk you into keeping the annual fee by offering some bonus or a statement credit. If you feel like it’s worth doing, go for it. But most of the time, it’s better to continue as planned.

When to downgrade or cancel: Make these decisions about a month before the annual fee is due. (If you’re using CashFreely’s automated reminders, you’ll get an email 45 days and 10 days before the fee is due.) The main reasons to make a change one month before: 1) You have time to pay off any balance for that month and redeem any points or cash back that may still be attached to the account; 2) You don’t have to worry about the annual fee hitting my statement and asking for it to be removed.

Note about American Express: Doctor of Credit has reported (on 4/10/19) that canceling an Amex card within 12 months may lead to them clawing back your initial welcome bonus! To avoid this, let the annual fee hit your statement. Then, you have 30 days to cancel and the annual fee will be refunded.

Two words of caution:

1) Be sure you know if you’ll keep your points/miles/cash back:

Bank rewards cards: If you have a bank card (like a Chase Sapphire, Amex Gold, or Citi ThankYou), you will most likely lose your rewards when you cancel or downgrade your card. All you have to do is simply redeem the rewards still left in your account for cash back before closing the account. Or, many times, if you have another account or a family member with the same kind of account, you can transfer or merge those rewards to the other account, then cancel the card.

Co-branded cards: If you have a co-branded card (like an airlines or hotel card – e.g. Chase Southwest, SPG Amex, Chase United Airlines), those points are tied to the loyalty program and are already out of your credit card account. So, you can cancel hotel or airline cards and never lose your points.

2) Don’t cancel a card if you’re in the process of getting a loan:

If you are in the process of closing on a mortgage or car loan, you may want to wait so that there are no changes to your credit. While canceling a card may only temporarily knock you for a few points, some lenders don’t want to see any changes while they are processing your loan.

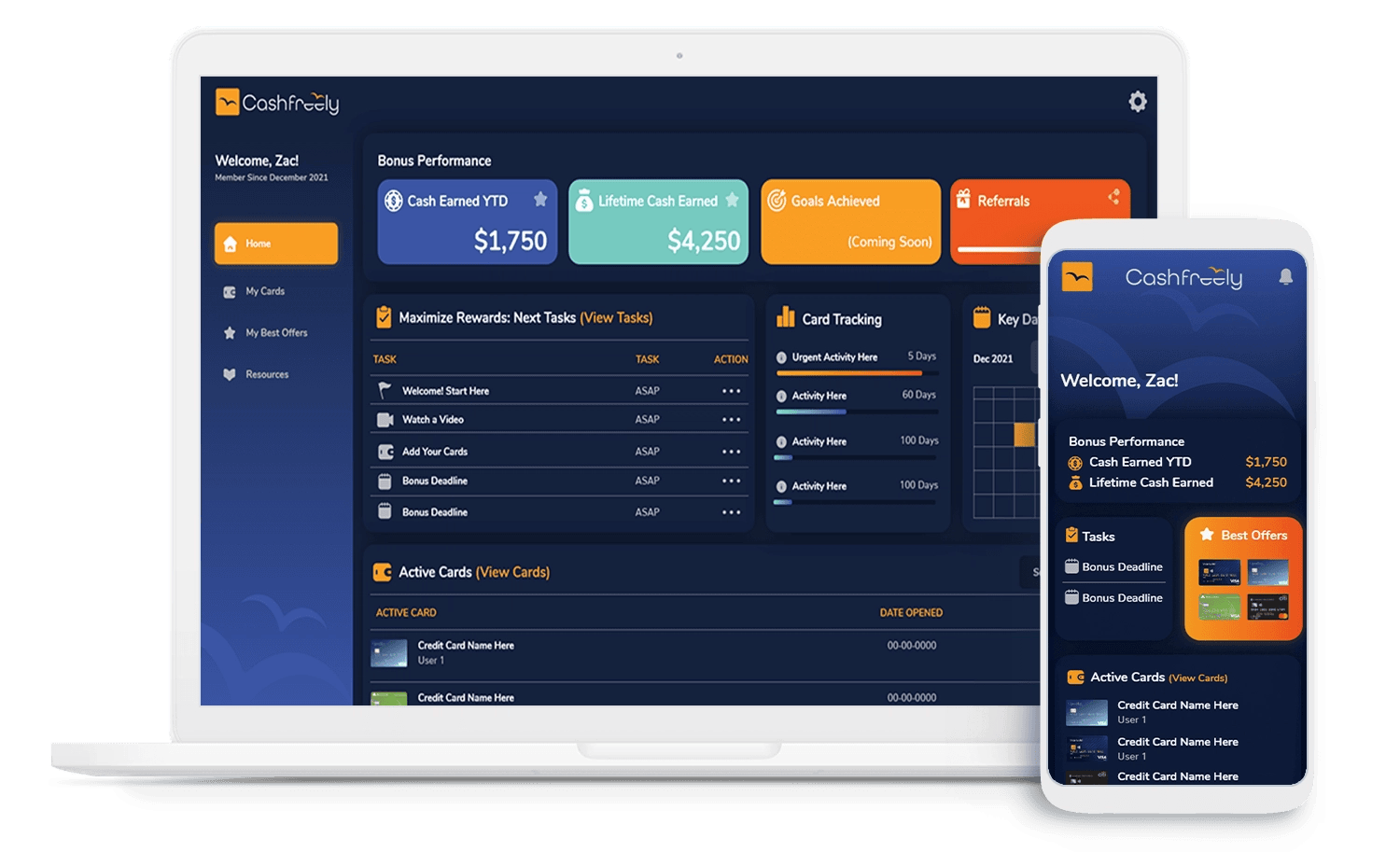

Want to put this process on auto-pilot? You can. CashFreely has the tools to notify you at the right time to make decisions on annual fees. In addition to annual fee reminders, you’ll get reminders for sign-up bonus deadlines, when you’re eligible to apply for new cards, and when you dip below 5/24 (for those who know about the 5/24 rule). Set it, and forget it with CashFreely.

Want to maximize your miles? Try CashFreely Today. It’s FREE.

Customer Service Numbers:

|

Phone: 1-800-528-4800 |

|

Phone: 1-800-732-9194 |

|

Phone: 1-866-928-8598 |

|

Phone: 1-800-955-7070 |

|

Phone: 1-800-432-3117 |

|

Phone: 1-800-347-4934 |

|

Phone: 1-800-347-2683 |

|

Phone: 1-888-852-5786 |

|

Phone: 1-800-432-3117 |