If you are serious about getting great cash back credit cards. You eventually need to know about the 5/24. More importantly, you need to be able to track your 5/24 number. Our free app CashFreely does just that. It tracks it for you! If you’re familiar with the Chase 5/24 Rule, feel free to skip over the explainer below. If not, here’s the background:

What Is the 5/24 Rule?

Chase has an unpublished policy for all of their credit cards where you will not be approved if you have opened 5 or more credit cards from any bank in the past 24 months. We refer to this as the 5/24 rule. However, some credit cards do not count against the 5/24 rule. To be organized with credit card rewards and card sign-ups, you have to be aware and track this rule.

You’ll often hear people say they are “6/24.” What they mean is they’ve opened 6 credit cards in the past 24 months. If you’re brand new starting out, you’re likely at a great spot: 0/24!

With that in mind, you may be wondering where the exceptions are? Let’s take a deeper look at the Chase 5/24 rule.

What cards count towards your 5/24 status?

It is important to know what credit cards will count towards your 5/24 status. Not all do. Knowing which cards count can help you plan your 5/24 strategy to maximize your benefits.

Personal Credit Cards

This is an easy one: all personal cards from any bank count towards 5/24.

There, that wasn’t so hard was it?

Business Credit Cards

Business credit cards are a bit trickier. Some count, but many don’t. Since some do, it is important to know which banks report to your personal credit report. The following banks will report on your personal credit report, and as a result, will count towards your 5/24 status:

- Capital One (with a few exceptions)

- Discover

- TD Bank

- UBS Bank

To my knowledge, no other banks report business card info on your personal credit report. This includes Chase, American Express, Citi, and others. So business cards that you open from any bank that’s not on the list above will not count towards your 5/24 status.

The important thing with Chase business cards is that you must be under 5/24 in order to be approved. Once approved, the card will NOT count towards your 5/24 status.

No business credit card yet? Check out some amazing offers on Chase Business Cards here and check here if you’re eligible to apply for a business credit card.

Authorized User

If you’re an authorized user on a card, it reports to your personal credit report. While Chase technically doesn’t count authorized user cards towards 5/24, it can be difficult to determine what cards you are an authorized user on or not. You may not technically be over 5/24, but Chase’s automated system will count you as being over 5/24 if you are an authorized user on some accounts.

If this happens, here’s what you should do:

- Call the Chase reconsideration line. 888-270-2127 if you applied for a personal card, 800-453-9719 if you applied for a business card.

- Explain that it is an authorized user account, and ask for them to remove it when doing a manual review.

- If the representative says that they do count, explain to them that you are not financially responsible for the account and they should remove it.

- If all this fails, hang up and call back. You’ll likely get a new representative who can help you.

In general, it is easier to avoid this altogether by not being an authorized user on any credit cards. If you already are, simply call the bank where you’re an authorized user and ask them to remove you. Also, ask them to remove the record from your credit report. It should take about 30 days for it to disappear, but will make your applications with Chase a lot smoother.

Do cancelled cards count?

Yes they do. It does not matter if you have the card active or cancelled. If you cancelled a card that you opened the card in the last 24 months, it will still count.

Product Change or Upgrade

It’s hard to say if a product change or upgrade will count towards your 5/24 status, as it all depends on how the bank processes the new account. In the majority of cases, it does NOT count because there is no new account created and no hard credit pull. Prior to upgrading or changing your card, you can ask the bank if they will proceed with a hard credit pull. If so, it’s probably a safe bet that the new card will count towards your 5/24 status.

From experience, I know that Citi has recently counted a product change as a new account. So, I would be careful with Citi.

Why Does the 5/24 Rule Matter?

a) Strategy is important.

The 5/24 rule means you need to be strategic with the order you apply for credit cards. For example, you need to go after the best Chase cards first in order to avoid being denied for being over 5/24.

b) Timing is part of the strategy.

You need to decide if you want to continue to get Chase cards in the future. That means spacing out your applications so that you don’t get in a hole for several months or longer while you wait to get back under 5/24. If you don’t value Chase cards, you can disregard this. But, most people love the bonuses and value that Chase cards bring for flights and hotel redemptions. Therefore, you need a system to monitor and watch this number.

The Great News

You can check your 5/24 number. There are multiple ways to go about it. BUT, there’s only ONE way to check your 5/24 number in UNDER 1 SECOND! That’s right. We’ve had some members check their 5/24 number in .01 seconds, in fact. And if you have a partner or spouse, it takes the same amount of time. Other sites have helpful guides that require you to use sites like www.creditkarma.com or your actual credit report in order to track this number. This takes 20-45 minutes EACH TIME, and it requires you to be ultra-organized and multi-task across browser tabs.

So, what’s that time and peace of mind worth to you? What if you counted wrong? What if you misread a date? You could be totally off when it comes to applying for your next card. How about automating the whole process?

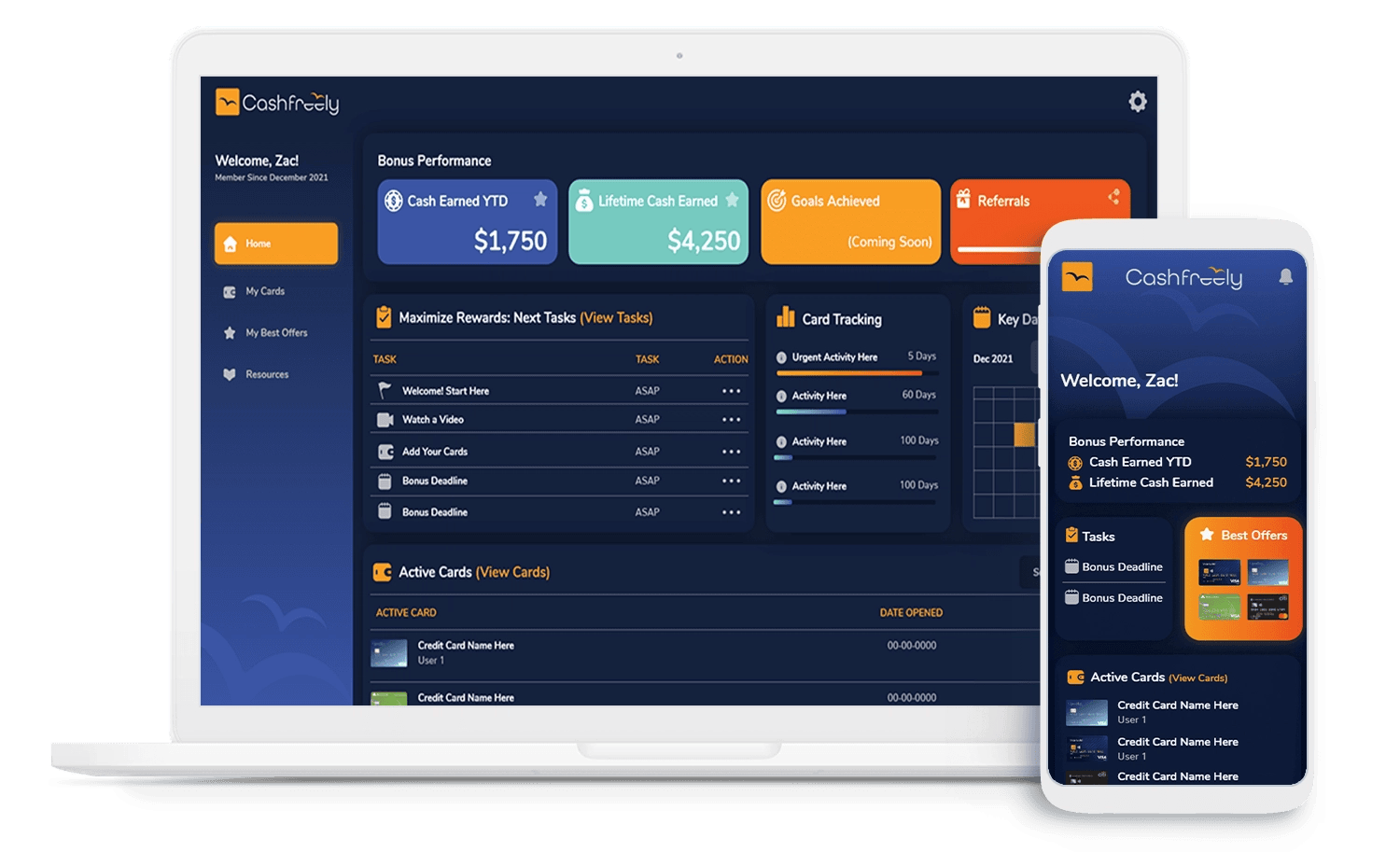

How CashFreely Automates Your 5/24 Count

Your 5/24 number is really a calculation. So why do it manually EVERY time you want to know it? We’ve got the system in place to track it for you (and your spouse) so that it’s right at your fingertips. We’ll show you what cards are counting towards your 5/24 count, and we include a countdown timer if you are over 5/24. If you’re a credit card expert, then you know… this is HUGE!

CashFreely also tracks when cards stop counting towards 5/24. Cards will drop off on the first of the month after the 24th month it has been open. For example, if you opened an account on January 13th, 2019, the counter would show you as being under 5/24 on February 1st, 2021. The first is chosen because that resembles how Chase’s system tracks 5/24 status.

5/24 Counter

The 5/24 Counter is on the Card Dashboard page. No need to spend time manually counting it up.Specific Cards Identified

The 5/24 Counter will identify the exact cards that are counted towards your 5/24 status, and even lists the date that each card will drop off.In summary, Chase made it a lot harder to acquire big bonuses when this unofficial rule came out. Let us do the work for you so you can keep planning your next free vacation.

NO credit card is required to sign up.

CashFreely exists to automate your credit card rewards lifestyle. Keep living the life you want without getting stuck in the logistical weeds. Utilize the 5/24 counter. Save tons of time. Have peace of mind, and maximize your rewards =)

https://cashfreely.net/6-reasons-why-we-love-the-chase-sapphire-preferred-card/