This post rounds out the guides to the big three transferable points programs: Amex Membership Rewards (this post), Chase Ultimate Rewards, and Citi ThankYou Rewards.

Amex Membership Rewards points can be earned via credit card spend, new account bonuses, credit card referrals, and more. Those points can then converted to cash back.

Amex Membership Rewards Guide

Below, you’ll find everything you need to know about Membership Rewards.

Earn Points

Credit Card Welcome Bonuses

The easiest and quickest way to earn Membership Rewards points is through Amex credit card welcome bonuses.

Most Amex welcome offers stipulate that you can’t get the bonus if you’ve ever had that card before. That said, it doesn’t preclude you getting a bonus for a similarly named card. Additionally, targeted offers sometimes do not have that once per lifetime language. In those cases, you can get the bonus even if you’ve had the card before.

Below are the Amex cards with the best current and public Membership Rewards welcome offers:

Personal

A must-have for anyone who loves Amex points. Some of the highest returns for spending at U.S. supermarkets and restaurants worldwide (plus takeout and delivery in the U.S). Definitely worth a spot in your wallet.

Terms apply.

This card has often been overlooked because of the American Express® Gold Card and the Platinum Card® from American Express, but solid spending categories make this an interesting card. Terms apply.

Business

Now with an increased welcome offer! This is a card comes loaded with benefits for frequent travelers. However, the very large annual fee needs to be weighed versus the benefits. Terms apply.

Higher than usual offer

Credit Card Upgrade Bonuses

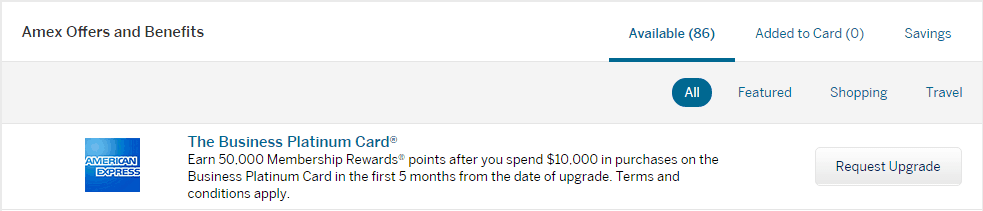

Amex frequently offers bonus points for upgrading from one card to another. These upgrade offers often do not have the once per lifetime language. That is, if you are targeted for an upgrade offer, you may be able to earn the bonus points even if you’ve had the card before. It is best to accept these offers only after you have earned a welcome bonus for the higher end card.

Amex Offers

Amex Offers are usually best for saving cash or earning bonus points (which can then be converted to cash back). With these offers all you have to do is add the offer to your card prior to making your purchase. For example, you might see an offer for ‘Spend $15 at Shake Shack, receive a $5 statement credit’, or ‘Spend $75 or more at Reebok, Get 1,500 Membership Rewards points’.

Credit Card Referrals

Another great way to earn Membership Rewards points is by referring friends and relatives. Log into your account to check for any special referral offers.

Log into your account and check the section titled “Amex Offers and Benefits” to look for offers like these.

Miscellaneous Other Options for Earning Points

Extended Payment Option

Amex charge cards often offer an easy way to earn additional Membership Rewards points. Once you sign up for a charge card, you will start getting emails and letters inviting you to sign up for the Extended Payment Option. This option essentially turns your charge card into a credit card. Don’t do it. That is, don’t sign up until the offer includes a bonus of 5,000 to 10,000 Membership Rewards points. In my experience, these bonus offers usually appear towards the end of your first year of card membership (as long as you haven’t enrolled already).

Once you get an offer like the one shown above, go ahead and sign up. As long as you keep paying your card’s complete balance each month, there is no downside to enabling this feature.

Redeem Points

Here we will guide you through redeeming your points for cash back as well as other ‘cash equivalent’ options. But, if you ultimately want to redeem your point for travel, read our travel-inclusive American Express Guide at our sister site, Travel Freely.

Cash back

Many American Express credit cards give you cash back in the form of “Reward Dollars,” such as the Blue Cash Preferred and Blue Cash Everyday. For these cards, when your balance is 25 or more, you can redeem them for a statement credit at a rate of 1.000 Reward Dollar to $1.00. These credits will go towards your next statement balance — which you can think of as pure cash — and the credit will usually appear within three days.

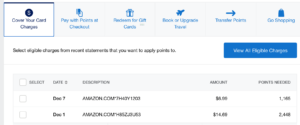

But with cards that earn your traditional Membership Reward points, you can receive cash back with the “Cover Your Card Charges” option. This will allow you to use points to pay for a purchase on your credit card statement. But unfortunately, the value is pretty poor and you’ll only earn 0.6 cents per point value. This is why those advertised as cash back cards versus travel reward cards, when it comes to American Express will be much better for you, if cash back is your end goal.

But, there’s a trick to maximizing your cash back. If you have the Amex Platinum by Schwab, you can technically cash out Amex points at 1.1 cents per point. See this article for more info.

Below are the best Amex cash back cards with their current welcome offers:

Personal

Definitely worth considering if you're looking for a cash-back card, as you'll earn 3% cash back on eligible purchases in several categories. Terms apply.

This is a great cash back card allowing you to earn 6% cash back at U.S. supermarkets (up to $6,000 per year in eligible purchases) and 3% cash back at U.S. gas stations. Terms apply.

As of 9/26/24, this card is no longer accepting new applications. This card has a solid welcome offer and 1.5% back on all purchases. You will receive cash back in the form of statement credits. Worth consideration if you need a cash-back card and like Amex. Terms apply.

Business

This $0 annual fee card is intriguing for the 2% cash back on the first $50,000 of purchases each calendar year, 1% thereafter. Cash back is earned in the form of statement credits. Terms apply.

Other ways to redeem points

You can also redeem points for gift cards or merchandise. Typically, the most you’ll get with this approach is 1 cent per point value, but usually you’ll get quite a bit less. However, there are times when American Express has special offers for gift card redemptions where you can potentially get slightly more then 1 that 1 cent per point valuation.

In this example below, at the time of writing this, you could redeem 47,059 American Express Membership Reward points for a $500 Apple gift card (new iPad anyone?). This gives a valuation of 1.06 cents per point.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your Ultimate Rewards points – causing you a headache in getting your points reinstated).

Manage Points

Combine Points Across Cards

Amex automatically pools all of your points together. When you earn American Express Membership Reward points with different cards, the point total shown when viewing either card is the total across cards. (This doesn’t apply for cash back cards which you earn in the form of reward dollars).

Share Points Across Cardholders

Unlike Chase and Citibank, Amex doesn’t allow members to move points from one person’s account to another. The only caveat is that if you are interested in travel at some point in the future, an authorized user or employee can transfer one person’s points to another person’s travel loyalty account.

How to Keep Points Alive

Thankfully, it is very easy to keep Amex Membership Rewards points alive. Simply keep any Membership Rewards card open. For example, if you are about to close your one and only Membership Rewards card, then open another Membership Rewards card account first in order to preserve your points. Amex offers some no-fee Membership Rewards cards, such as the Blue Business Plus and the Amex Everyday, so this shouldn’t be much of a burden.

As of 9/26/24, this card is no longer accepting new applications. Terms apply.