Check out our top business cards by going to our Hot Card Offers page, or logging into your CashFreely account for our personalized recommendations.

Once people learn the basics of earning cash back from their credit card, they start thinking of how they might maximize their situation. One of the easiest ways to maximize your cash back is to get a business credit card. Why? Business cards have some of the highest signup bonuses and some have great ongoing benefits as well. Many banks, airlines, and hotels have a business card version of the personal card that you may already have. By getting just one business card, you can get a BIG bump to your cash back total.

This is certainly true for those who start out with a Chase Sapphire Preferred personal card. The business card to get would be the Chase Ink Unlimited because it has a huge bonus for a no-annual-fee card and also earns cash back in the form of Chase Ultimate Rewards points. The next best business card is the Chase Ink Cash.

Looking for instructions on how to apply for a business credit card? Click here to skip down below for step-by-step instructions and a video walkthrough.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

There’s a myth out there that you have to operate a big company with multiple employees in order to be eligible for business credit cards. This is NOT true. This article will talk about who can qualify for a business card, what is required, and what one needs to consider when applying.

What Qualifies as a Business?

First of all, let’s define what a business is in terms of being eligible for a business credit card. A business can be any occupation, profession, or trade that earns income. So, if you have employees and make a large amount of business income, you are obviously eligible. But, if you just have a small side job, you could still consider yourself a business.

If you are thinking, I work for someone else so I can’t get a business card. Here is a question to ask yourself. Do you have any kind of side job that brings in extra money throughout the year?

Here are some examples:

- Photography

- Coaching

- Freelancing

- Consulting

- Yoga instructor

- Babysitting

- Blogging

- eBay or Craigslist selling

- Tutoring

- Dog sitting

The Facts about Business Credit Cards

a) Your business does not need to be your primary income generator. If you just earn a few hundred dollars a year, you still technically have a business.

b) You do NOT need employees to designate a business. See the next point on being a Sole Prop.

c) You do NOT need to file a formal business application to be considered a business. Therefore, you do not need a Tax ID or EIN number in order to apply for a business. Anyone making a profit can be considered a sole proprietor. Sole proprietors are not required to file paperwork. This means that you would use your social security number on business card applications.

When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business’ address and phone, and your social security number as the business’ Tax ID / EIN. However, it may help your approval odds to have an EIN, and you can get one for free from the IRS, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Almost everyone I know uses business cards for some personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: Don’t use the card for personal expenses if you’re not comfortable doing so. At the minimum, make sure you have a great way to track receipts or keep your accounting separate.

There are many great reasons to get a business card for business purposes, such as keeping expenses separate, building up a business credit history, getting extra protection on items purchased, etc.

Reasons to get a business card for cash back:

1) BIG Bonuses

In many cases, a bank’s business signup bonus is higher than the bank’s personal card signup bonus. On average, businesses spend far more than individuals, so while the minimum spending requirement may be higher (ex. $5,000 in 3 months for many cards), the bonuses are better too. For example, most personal cards have bonuses ranging from from $400 to $500 cash back, while business bonuses can be $600 to $1,000 cash back. Our favorites is the Chase Ink Business Unlimited and the Chase Ink Business Cash.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

2) Multipliers

Some business cards have much better multipliers (e.g. 2%, 3%, or even 5% cash back for certain purchase categories). For example, the The Chase Ink Cash has a 5% cash back for some utilities and purchases at Office Supply stores.

3) Let your personal card applications take a rest.

With the 5/24 rule (read here how to Check Your 5/24 Status INSTANTLY), there may be times where you want to take a hiatus from personal applications. Getting a business card can allow you to continue to earn signup bonuses without impacting your 5/24 number. Note: Some Chase will not approve you for some business cards (notably the Chase Ink) unless you are under 5/24.

Hitting spending bonuses

Many people like the idea of getting a business card and a great signup bonus, but they can’t make the minimum spending to hit the bonus. Especially if you have a small business on the side, you may only spend a few hundred dollars per month.

If the signup bonus requires $4,000+ in spending, that can feel difficult to achieve. Some cards have a disclaimer that you must only use a business card for business expenses. However, many business owners choose to combine personal and business spending in order to hit the bonus. With that approach, it is a matter of keeping track of your accounting for personal and business expenses when the statement comes.

In summary, far more people are eligible for a business credit card than you may think. With that said, some of the best cards may require a higher level of business income and a business credit card specialist may want to ask more specifics about your income and expenses before you get approved.

Ready to get a business credit card?

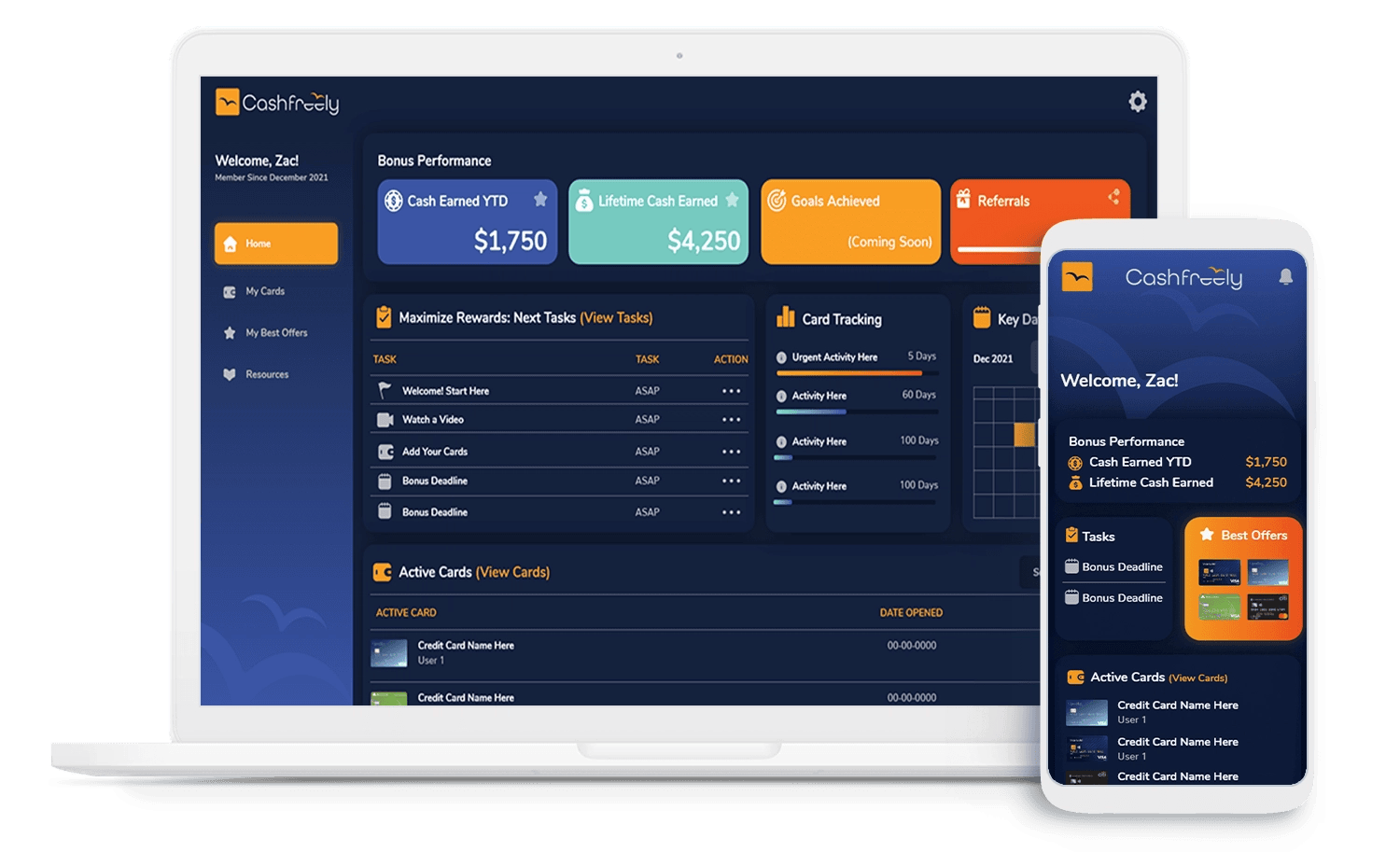

If you want to jump in and get going with a great overall business card, the Chase Ink Business Unlimited is the way to go. It has an incredible bonus, where your points can be easily redeemed for cash back. Read more about the Chase Ink Unlimited Business card. Also, Log In and go to your CardGenie recommendations to search by business cards.

How to Apply

Click through the on your favorite card to apply. (Use CashFreely links to support the site.)

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

card id=39]

Tell them about your business

The first part of the application is about your business. If you already have a well established business, then the answers should be straightforward. If you are just getting started with your business, below are examples of how to fill this out. These answers assume that you do not have any employees and you operate as a sole proprietorship (which is the most basic form of a business). Use your judgment to answer differently if the examples given don’t match your circumstances:

Business Information

- Legal Name of Business: If you don’t already have a business name, I recommend using your own name as the business name.

- Business Name on Card: Again, this can be your own name if you don’t have a business name to use.

- Business Mailing Address: This can be your home address if you don’t have a separate business address.

- Type of business: Sole Proprietor

- Tax Identification Number: This can be your SSN, but I you can also create an EIN for your business (found here)

- Business category/type/subtype: Pick whichever categories are closest to your business

- Number of Employees: 1 (you)

- Annual Business Revenue: 0 (or project an amount based on monthly revenue to-date)

- Years in Business: (number of years you’ve been operating the business with or without revenue)

Personal Information

This part of the application is about you, personally:

- Authorizing Officer: Owner

- Gross annual income: Include all of your income, not just business income

- The rest should be self explanatory

How to improve your chances of success

The following tips can help with approval, but none are guaranteed:

- Use an EIN instead of your SSN when entering your Business Tax ID on the application

- Do not call if your application goes to pending

- Call if your application is denied

- Try a Special Consideration Form if you are denied (and if calling doesn’t help)

Do not call if your application goes to pending

When applications go to pending, people frequently find that they get approved without calling. When people do call, they often get tough analysts who deny the application.

The approval process goes through up to 3 “gates”:

- Instant Approval (this is rare with Ink business cards)

- Automatic Approval, sent by mail (may take several weeks)

- Analyst Phone Approval

If you’re not instantly approved, then calling bypasses gate 2 and may reduce your overall chance of approval. Instead, I recommend waiting to get a letter in the mail. Hopefully it will say “congratulations”.

Of course, if you are contacted for more information then you absolutely should talk to them on the phone. In some cases they may simply need more information about you or your business before your application can go through the next review stage.

Call if you are denied (and call again)

If your application is outright denied (either instantly or by mail), then call the reconsideration line (numbers are here). There are many cases where analysts have overturned denials over the phone.

The analyst will likely ask a lot of questions. Make sure your answers match your application. Also, if you already have multiple business cards, make sure to let the analyst know that you don’t need more credit. Tell them that you are willing to move available credit from another card or to cancel another card if necessary. Be prepared to answer financial questions about your business. Be prepared to answer questions about why you want the card and how you expect to use it. There is absolutely nothing wrong with saying that you were attracted “by the welcome bonus and by the 5% cash back categories” (for example).

If the analyst doesn’t approve your application, call again. Many people have had luck simply calling a few times until the reached an analyst willing to take a chance on their business.

This is totally eye opening for me Zac. For years, I figured only bigger enterprises would be eligible for a business credit card. Definitely changed my view bro. I am eligible likely, and am happy to know this 😉 Thanks for sharing 🙂

Ryan

Thanks, Ryan. It can be so helpful for many small businesses and those who have a small side business. For those struggling to make a profit, it can be a nice little bonus too! Same goes for nonprofits who could save some money every year on airfare or other expenses.