If you spend a lot on groceries, then it’s time to maximize your spending on those purchases! The list below includes our favorite cash back cards for groceries.

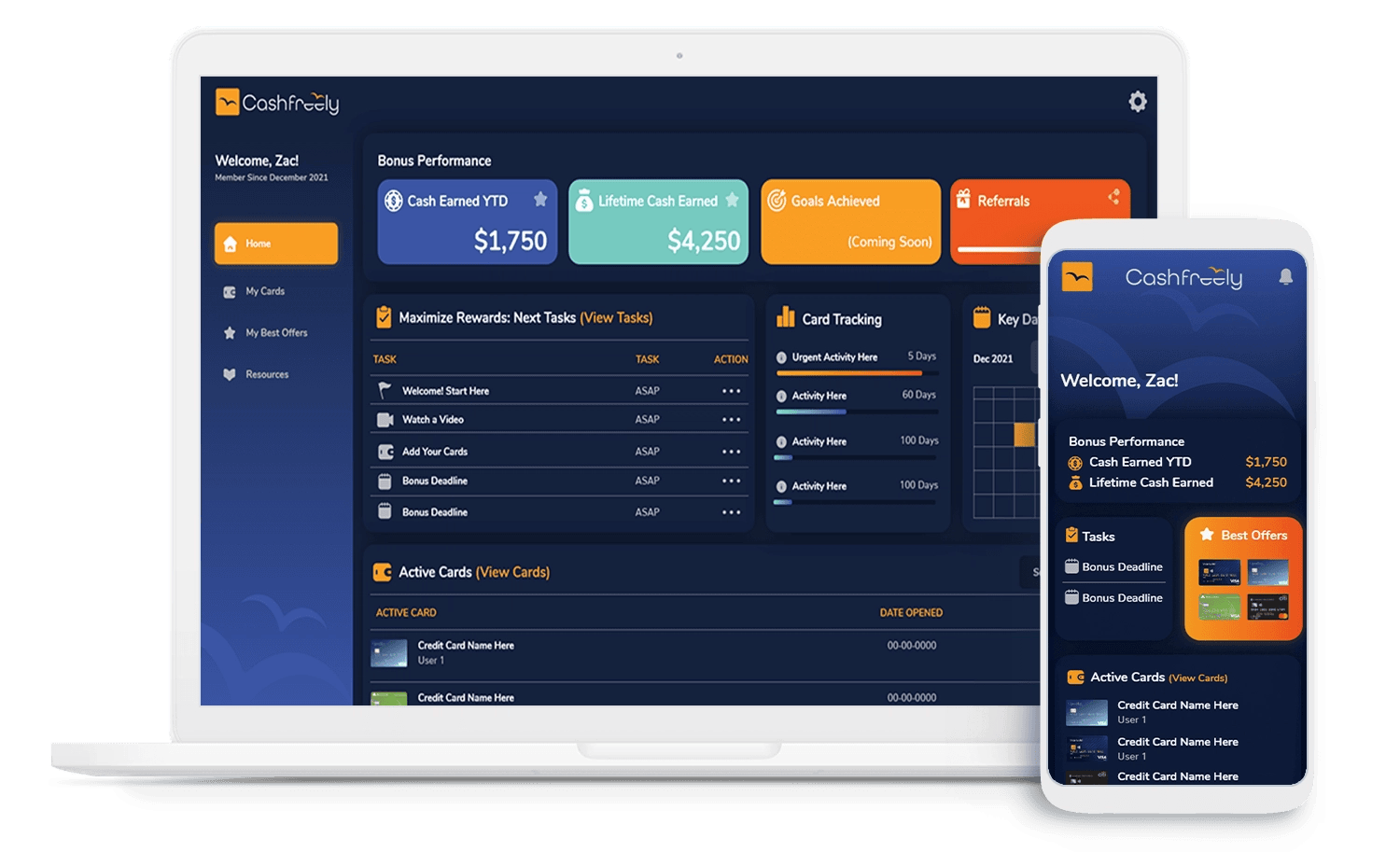

At CashFreely, we are all about maximizing cash back in the least amount of time. The #1 way to do this is through great signup bonus offers that lead to lots of cash back in the first few months of getting a new card. Most people will earn way more cash back in one signup bonus compared to the ongoing cash back they earn with everyday purchases. For our top-ranked offers, go to this page.

That said, let’s talk about our picks for the best cash back cards for groceries.

A few extra notes: In general, the spending category of groceries does not include groceries purchased at big box stores like Target, Costco, Wal-mart, or at convenience stores or drugstores. American Express cards, from our partners, limit your earning to U.S. based supermarkets. Some cards offer higher earning in several categories, but only apply the bonus earning for the top 2-3 spending categories each month. Lastly, some cards have a cap on how much you can earn on groceries each year before it drops down to 1%. In summary, make sure to read our notes and the fine print to know what the terms are.

Curious about our favorite cards for gas and dining? We’ve got you covered:

Best Cash Back Cards for Gas Purchases

Best Cash Back Cards for Restaurants

Our Picks: Best Cash Back Cards for Groceries

Blue Cash Preferred® Card from American Express

Earning rate on groceries spending: 6% cash back (capped)

Notes: Earn 6% cash back on first $6,000 of spending every year at supermarkets (1% cash back after that); only valid at U.S. supermarkets.

Annual Fee: $95, waived for the first year.

This is a great cash back card allowing you to earn 6% cash back at U.S. supermarkets (up to $6,000 per year in eligible purchases) and 3% cash back at U.S. gas stations. Terms apply.

Blue Cash Everyday® Card from American Express

Earning rate on groceries spending: 3% cash back (capped)

Notes: Earn 3% cash back on first $6,000 of spending every year at supermarkets (1% cash back after that); only valid at U.S. supermarkets.

Annual Fee: $0

Definitely worth considering if you're looking for a cash-back card, as you'll earn 3% cash back on eligible purchases in several categories. Terms apply.

Capital One SavorOne Cash Rewards Credit Card

Earning rate on groceries spending: 3% cash back

Annual Fee: $0

Very solid cash back card with a bonus and no annual fee. Very attractive 3% on grocery stores (excluding superstores - e.g. Walmart and Target), dining, entertainment, and streaming services. The ability to convert this earning to Capital One miles is a great idea if you have a Capital One Venture Rewards Credit Card.

Citi Custom Cash® Card

Earning rate on groceries spending: up to 5% cash back (depends on other spending)

Notes: This card offers 5% cash back in the category in which you spend the most each billing cycle, for up to $500 of spending; Groceries is one of the included categories eligible for 5% cash back.

Annual Fee: $0

Citi Strata Premier® Card

Earning rate on groceries spending: 3x ThankYou® points (which is 2.25% cash back equivalent)

Notes: Also earn 3x on dining and groceries.

Annual Fee: $95

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

Bottom line

If you’re new to the world of cash back credit cards, then you may be wondering what all the hype is about. Or, maybe you’ve dipped a toe into the cash back rewards world but feel you have a lot still to learn. Getting your first card to maximize a major monthly expense is a great start. Of course, getting started is much easier with us.

Let us help you earn $1,500+ in cash back every year.