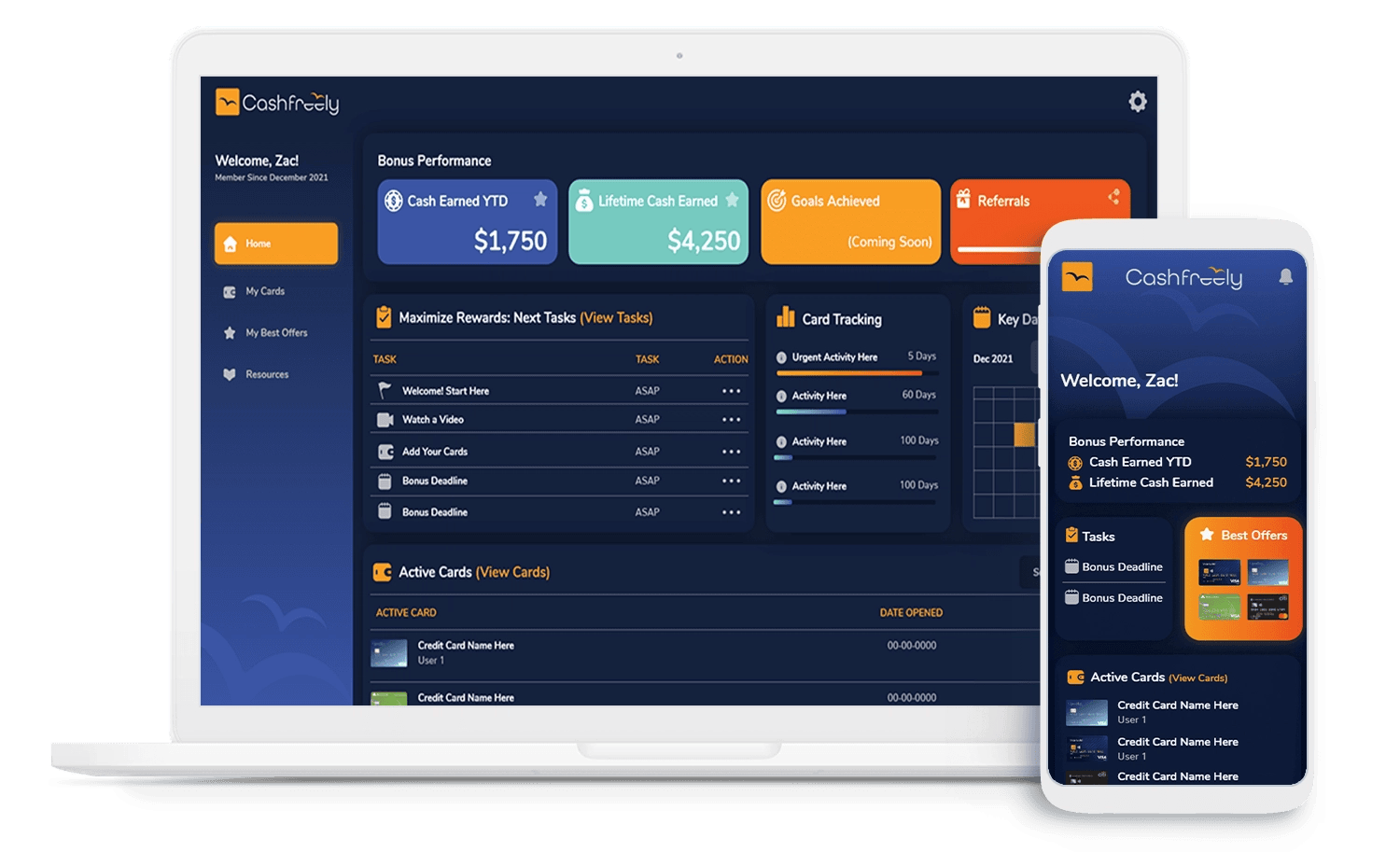

We’ve simplified things with our “Best Of” rankings for best cash back credit card offers. If you don’t have time to research cards, take advantage of our expertise! CashFreely is here to help you with the best cash back credit card offers. Need a primer on cash back cards? Sign up for CashFreely (for free) or check out Cash Back Cards 101.

Don’t Let Offers Disappear – We’ve seen a LOT of offers come and go. Some offers have clear expiration dates, and others just vanish without warning. My advice: If you are ready for another card and you know the card you want… Don’t delay!

Brand new here? Cash Back Starts Here.

Make sure you sign up for CashFreely – it’s free, and you’ll immediately get access to custom recommendations for the best credit card offers. CashFreely is 100% Free. We don’t ask for credit card info or any sensitive information. Want to know more? Check out the benefits and features of our 100% free tool. Need help filling out an application? Here’s How to Apply for a Credit Card.

Best Cash Back Credit Card Offers for March 2026

At CashFreely, we are all about maximizing great signup bonuses with the best cash back credit cards. Our approach is to get the most cash back in the least amount of time. Signup bonuses are the #1 way to rack up cash back without spending a lot of money. Some people get more cash back in one bonus than they would in an entire year’s worth of spending on the same old card they’ve had for 5 years. Check out the BEST deals here.

-

- Overall Starter Best Cash Back Credit Card: Chase Sapphire Preferred® Credit Card ($750 cash back)

- Overall Best Business Cash Back Card: Chase Ink Business Cash® Credit Card ($750 cash back) or Chase Ink Business Unlimited® Credit Card ($750 cash back)

- Best Cash Back Personal Card for low spenders: Chase Freedom Unlimited® (1.5% cash back on everything) or Citi Double Cash® Card (2% cash back on everything)

- Easiest Cash Back Earning Personal Card: Citi Double Cash® Card (2% cash back on everything)

- Best Card for Gas, Groceries, and Restaurants: Citi Strata Premier® Card (2.25% cash back on gas, groceries & restaurants)

- Best Cash Back Card for College Students/Grads: Discover It Student

- Best Personal Cards for Carrying a Balance: Citi Double Cash® Card or Blue Cash Everyday® Card from American Express

- Best Business Card for Carrying a Balance: Chase Ink Business Cash® Credit Card ($750 cash back) or Chase Ink Business Unlimited® Credit Card ($750 cash back)

- Best Personal Balance Transfer: Citi® Diamond Preferred® Card or Citi Double Cash® Card

Amazing Offers on Chase Business Cards

Important Update on Eligibility (November 2025): Chase has introduced new pop-up language for the no-annual-fee Chase Ink Business Unlimited® Credit Card and Chase Ink Business Cash® Credit Card, making welcome bonus eligibility a bit less predictable. Similar to the recent changes on Sapphire products, Chase now states the bonus may not be available if you’ve ever had these cards – or any Chase business card without an annual fee – and the good news is that you should get a pop-up to let you know if you’re not eligible.

Chase Ink Business Cash

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

Incredible signup bonus for a no-fee card. An excellent companion to the personal Sapphire Preferred or Sapphire Reserve for even more cash back. Like the personal Sapphire cards, this card earns valuable Chase Ultimate Rewards® points with the option of converting to cash back.

- Earn 5X rewards (worth 5% cash back) on first $25k spent for phone, TV, internet, and office supply stores

- Earn 2X rewards (worth 2% cash back) on the first $25K spent for gas and restaurants

- Cash out points for 1 cent per point (e.g. 75,000 points = $750 cash)

- No Annual Fee

Chase Ink Business Unlimited

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

An all-round great cash back business card with no annual fee. It’s very simple. You earn unlimited 1.5 points (1.5% cash back) per $1 spent on all purchases. This can be a great standalone card, but it is an excellent companion card to the Sapphire Preferred or Sapphire Reserve for even more cash back.

- Earn 1.5X rewards (worth 1.5% cash back) on Everything

- Cash out points for 1 cent per point (e.g. 75,000 points = $750 cash)

- No Annual Fee

Chase Ink Business Preferred

A highly recommended business card for its signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

This business card has a great signup bonus and 3X categories. It’s hard to beat the Chase Ink Business Preferred if you’re looking for an all-around business card.

New Eligibility Rules for the Ink Business Preferred® Credit Card as of November 2025: The new cardmember bonus may not be available to you if you have previously had this card. Chase may also consider factors pertinent to your business in determining your bonus eligibility.

- Earns 3X rewards (worth 3% cash back) on travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year)

- Cash out points for 1 cent per point (e.g. 100,000 points = $1,000 cash)

- Cell phone protection against theft or damage

- No foreign transaction fees

| Card | Signup Bonus | Spending Required | Annual Fee |

|---|---|---|---|

| Ink Unlimited | $750 | $6,000 in first 3 months | $0 |

| Ink Cash | $750 | $6,000 in first 3 months | $0 |

| Ink Preferred | $1,000 | $8,000 in first 3 months | $95 |

Our Top Recommendations for Carrying a Balance

Best cards for Intro Purchases and Balance Transfer: If you’re looking to carry a balance, think about the Citi Diamond Preferred World Mastercard. The next best option would be the Citi Double Cash® Card. Note: You do not earn cash back for balance transfers. Make sure to check terms when applying. For great introductory offers, check out the Amex Blue Cash Everyday or Chase Freedom Unlimited because they also have a welcome bonus.

Now with a signup bonus! A great complement to the Citi Strata Premier® Card.

Definitely worth considering if you're looking for a cash-back card, as you'll earn 3% cash back on eligible purchases in several categories. Terms apply.

With this card, you typically earn 3% cash back on dining (including takeout and select delivery services), 3% cash back on drugstores, 5% cash back on travel purchased through Chase Travel℠, and 1.5% cash back on everything else.

Best Business Cards for Carrying a Balance

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

Great signup bonus for a business card with no annual fee. Great for carrying a balance.

What’s Our Criteria for the Best Cards?

-

- Bonuses — CashFreely seeks to maximize signup bonuses, so if great signup bonus offers come out, those cards will move up in the rankings.

- Value of points — Not all points and miles have the same value when it comes time to redeeming them. We take this seriously when helping you find the best credit cards with cash back rewards.

- Bonus spending requirement — We rank cards lower that require major spending ($10,000+) as part of signup bonuses.

- Ease-of-use — Factors such as customer service and ease of cashing out play a factor in our rankings. We don’t want you to spend hours on the phone with poorly trained, off-shore customer service when you have a question about your card.

Want personalized recommendations? Log In to your account to see your personalized Best Offers.