As financially savvy as people are these days, it’s amazing how many smart people are using the wrong credit card. (Not to mention that so many people are still using debit cards that don’t earn any points at all.) The biggest mistake I see with beginners is that they “think” they have the best card for their situation, and they are proud of how much rewards they get, such as cash back.

The truth is, they are nowhere close to maximizing their rewards. If this is you, or you’re a total beginner without any credit cards, I’m here to help.

Right now you might be thinking to yourself that you want a cash back card, and you might be very right in your thoughts. But, before you go ahead and apply for a card, I want to make you aware of all of the different types of reward credit cards. They each have their pros and cons, so we’ve gone through each category to see why we like them.

1. “Secret” Cash Back “Wild” Cards

This type of card is the most recommended for beginners. These cards are actually the most valuable and flexible. They can be redeemed for cash back, gift cards, and almost any type of travel.

The rewards for these cards are tied to the bank’s rewards programs. The big names are Chase (Chase Ultimate Rewards), Citi (Citi ThankYou Points), and American Express (Amex Membership Rewards). One of the best starter cards is the Chase Sapphire Preferred card. Often, these cards offer a great sign-up bonus for an annual fee of around ~$100, but sometimes the first-year fee is waived. Sign-up bonus values can range from $250 to $750 (or even more).

Our favorite is the Chase Sapphire Preferred: Why We Love Chase Sapphire Preferred.

Related Articles: Chase Ultimate Rewards Guide, Amex Membership Rewards Guide, Citi ThankYou Points Guide

2. Pure Cash Back Credit Cards

If you know you only want cash back, in addition to the cards mentioned above, there are many others that truly just give you cash back. These cards are incredibly easy as you typically don’t have to even ‘redeem’ your points, you’ll just receive the cash back (many times in the form of a statement credit) at the end of each billing cycle.

These cards usually come with no or low annual fees, but you’ll notice the higher the fee (still usually less than $100 per year) will offer more cash back with certain category purchases. You’ll typically see many common categories, such as gas, restaurants and dining out awarding bonus cash back opportunities. For example, the American Express Blue Cash Preferred and American Express Blue Cash Everyday are two popular cards that offer cash back for popular bonus categories.

However, you’ll also find that many oft these pure cash back cards don’t offer as high as a welcome offer as the transferable cards listed above. For example, the Citi Double Cash Card is one of the easiest to use cash back cards — where you earn 2% cash back on all purchases (1% when you make the purchase, then 1% when you pay your bill), but there’s no welcome offer.

3. Reimbursement for Free Travel Cards

The Capital One Venture card works differently than the programs with Amex, Chase, and Citi. These miles end up serving as statement credits towards travel purchases you have already made. This can be super helpful if other rewards don’t cover certain travel expenses, or you find cheap flights that are a better value than redeeming points for an award flight. Note, Capital One Miles are also transferable.

Why do we like Statement Credit cards? Ease and diversity of use.

Think of these cards as helping to pay for all kinds of travel: airfare, hotels, Airbnb stays, trains, cruises, tours, or other travel-related expenses. You use the card for your travel expenses, then you reimburse yourself for the purchases on your credit card statement, like a rebate, using your miles. As long as the charge codes as a travel purchase on your credit card statement, you can reimburse yourself with your miles.

Example 1: Let’s say you go to Europe with free flights using Chase points. You can use Venture Miles or Arrival Miles to get other travel expenses covered. For example, you get 2 train tickets in Europe for $250. You can use your Venture card to purchase them. Then, a month later you can use 25,000 miles to reimburse yourself for the $250 charge. These miles can also work if you find an awesome hotel on Priceline, Hotels.com, or want to stay at an Airbnb.

Example 2: I love using Costco for rental cars. I can pay for the rental car with my Capital One Venture card, then redeem miles to pay for the charges on my statement.

The strength of this type of card is that you don’t have much to figure out. You purchase your travel with the card. You reimburse yourself later with miles.

Some people wait to get a credit card until right before they travel. If they get this type of card, they can go ahead and use the card on the trip for travel purchases that will end up being free. In other words, you don’t have to hit your bonus on the card before you can make rebate-eligible purchases with it. So if you are leaving for Europe in three weeks, consider getting one of these cards so you can get some free travel. These miles come in super handy when you want to do that excursion or tour that would otherwise be outside of your travel budget.

Pro Tip: Points enthusiasts are not as keen on these kinds of cards because their value has a low ceiling, whereas rewards programs with transfer partners can be really valuable. For example, you could get an International Business Class ticket by transferring 70,000 Chase Ultimate Rewards points and booking with United Miles. If you used a Venture card to reimburse yourself based on the retail price of the ticket, that ticket may cost you $6,000, meaning 600,000 Capital One Miles!

Quick note on No Annual Fee Credit Cards: Great if you’re starting out or building credit

There are some really good cards that do not have an annual fee. While cards with an annual fee will generally have higher sign-up bonuses, you can still get some good bonuses and good value out of no annual fee cards.

Why do we like No Annual Fee cards? They are essential.

No Annual Fee cards are still great to have for several reasons. If you’re just dipping your toes in credit cards or don’t spend a lot, a no annual fee card can be an easier way to get a bonus. Additionally, people without credit history need to get a starter card to establish a history of good credit and on-time payments. With a no annual fee, you can keep building up your credit without worrying about any fees.

Remember, it’s always good to keep your oldest credit card. I made this mistake several years ago before I knew any better. I thought I was helping my credit score by getting rid of the card. However, your oldest card has the longest credit history. The banks love to see a long history of good credit. If you cancel your oldest card, you will lose that good history.

Note: Many people absolutely refuse to pay extra fees to a bank. That’s totally understandable. If you’re doing that on principle, it’s important to do the math in order to see if a card with an annual fee would actually bring you more value. For example, if a “no annual fee” card gets you $200 cash back, you are netting a $200 cash. If a $95 annual fee gets you $600 in cash back, you are up to $505. Keep in mind, many annual fee cards have the first year waived, and you always have the option to either cancel or downgrade a card in the future if you don’t want to pay the annual fee in the future.

So, here’s the question. What kind of cards do YOU want in your wallet?

Earn $200-300 in rewards last year?

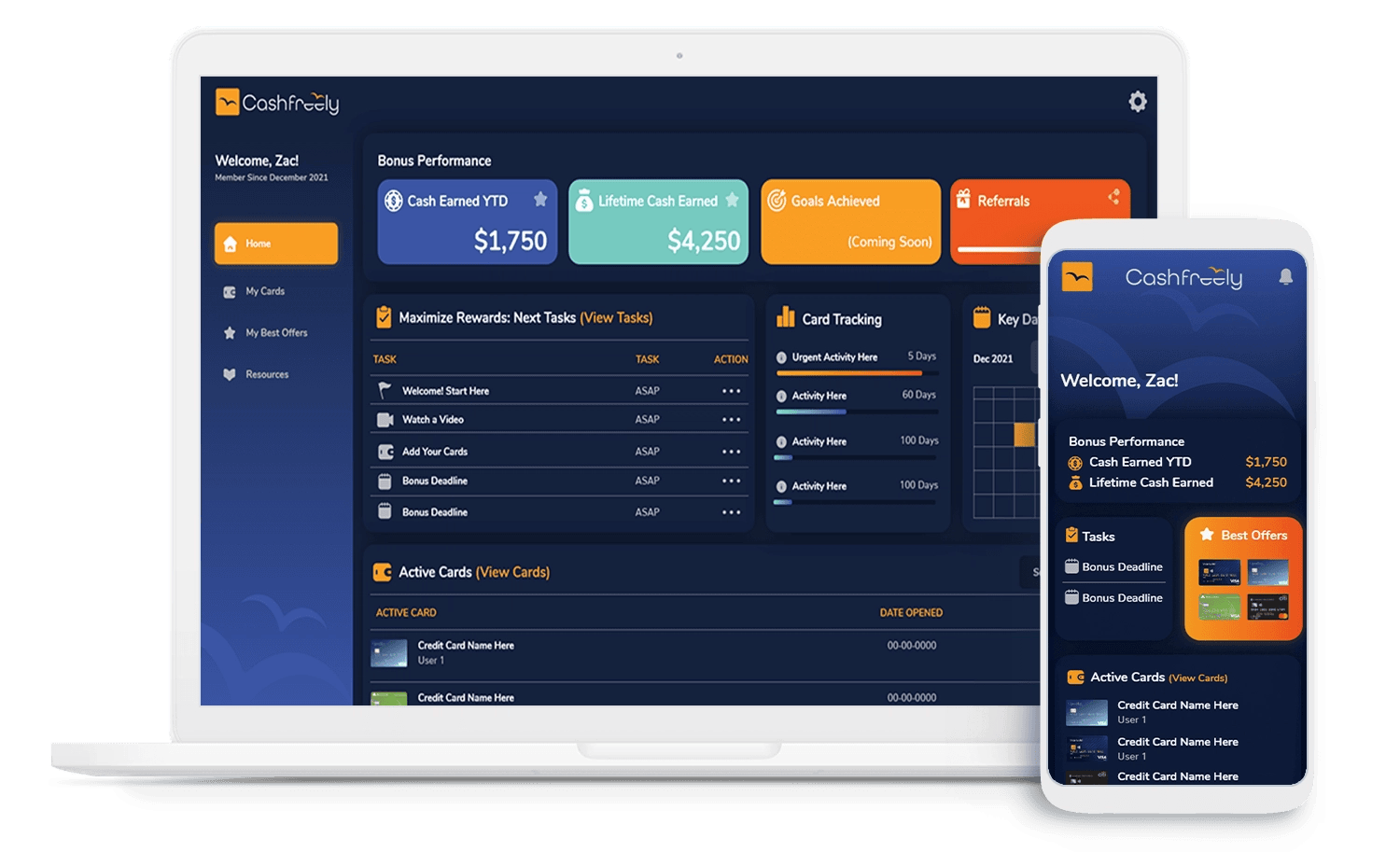

CashFreely members average $1,500 in cash back EVERY year!

Sign up now for CashFreely. It’s FREE. =)

Get custom, personalized recommendations with CashFreely’s Hot Offers recommendations. Sign up for free and see what’s best for you.