The Citi Strata Premier® Card (formerly Citi Premier® Card) is Citi’s premier rewards credit card that earns valuable and flexible ThankYou® Points. It competes with other premium cards like the Chase Sapphire Preferred® Card, American Express® Gold Card, and Capital One Venture Rewards Credit Card. It is the primary card for Citi, with excellent spending categories and an easy way to redeem your points for cash back.

Additionally, points earned from the Citi Strata Premier card can also transfer to various transfer travel partners at a 1:1 ratio. If you might be interested in redeeming your points for travel at some point down the road, visit our sister site, Travel Freely, to learn more.

This guide has everything you need to know about the Citi Strata Premier, its benefits, and how it fits into the ThankYou Rewards ecosystem.

Citi Strata Premier Application Tips

Citi Application Tips

|

Should you apply?

The Citi Strata Premier card typically has a reasonable welcome bonus that can equate to some great cash back right in your wallet. It also has excellent bonus categories for ongoing spend in the most common categories like dining, gas and groceries. And the Strata Premier offers travel protections like Trip Cancellation and Trip Interruption (Common Carrier), Trip Delay, Lost or Damaged Luggage, and MasterRental Coverage (car rental insurance) — a benefit that was taken away from the card’s predecessor.

If you are eligible (see next section), the welcome bonus on this card certainly makes it worthwhile for at least the first year.

Are you eligible?

To get this card, it must be 48 months since you last received a new account bonus for the card. Additionally, if you converted another Citi credit card account into a Citi Premier or Citi Strata Premier account, it must be 48 months since you received a new account bonus on the original Citi credit card.

Previously, downgrading and closing cards were known to impact your new bonus eligibility but that no longer appears to be the case.

How to apply

You can find the current best welcome bonus information below. Click the card name to go to our Citi Strata Premier card page to find more information and a link to apply.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

Application status

After you apply, call 1-866-252-0118 to check your application status.

Reconsideration

If your application is denied, definitely call 1-800-695-5171 for reconsideration. It’s surprising how often denials can be changed to approvals just by asking.

Perks

Below are the perks you’ll receive with the Citi Strata Premier card:

Travel Benefits

- Transfer Points to Partners: Points can be transferred 1:1 to a number of airline and hotel loyalty programs, but not all (for example, Choice Privileges is 1:2).

- $100 Annual Hotel Savings Benefit: Once per year you can apply a coupon for $100 off on an after-tax hotel booking of $500 or more.

- No foreign transaction fees: The Strata Premier and the Strata Elite are the only currently available cards that earn ThankYou points which do not charge foreign transaction fees.

Travel Protections

The Citi Strata Premier includes travel protections. These include:

- Trip Cancellation and Trip Interruption (on common carriers)

- Trip Delay

- Lost or Damaged Luggage insurance

- MasterRental Coverage (aka Mastercard®’s car rental insurance).

These benefits are pretty standard on most travel cards.

Purchase Protection

- Extended Warranty: Citi extends the manufacturer’s warranty by 24 months on items with a manufacturer’s warranty of 5 years or less. This is the best extended warranty coverage of any issuer.

- Damage and Theft Protection: Covers your new purchases for 90 days against damage or theft up to $10,000 per claim and $50,000 per calendar year.

Earn Points

Intro Bonus

This card earns ThankYou points. Here’s the current welcome offer:

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

Redeem Points

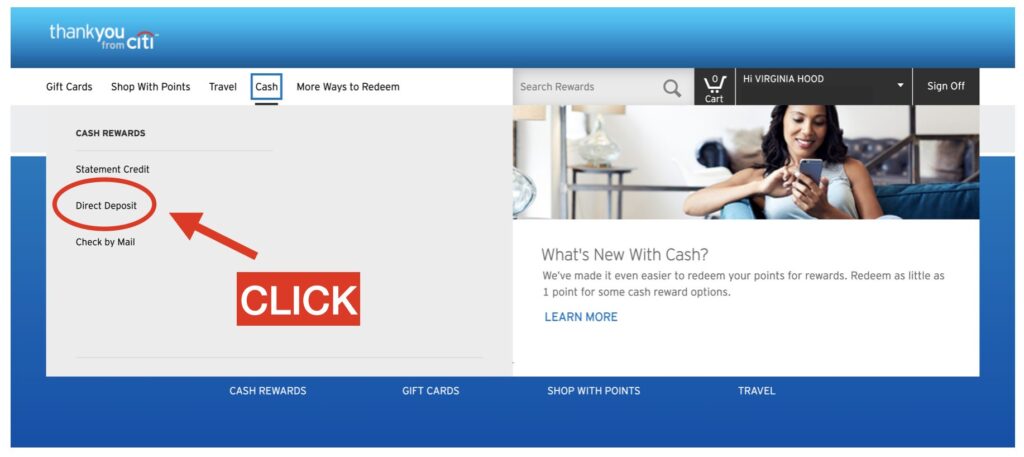

Cash Back

As of 8/24/25, cardholders can redeem points for 0.75 cents per point each either as statement credits or as cash back. This is the same for the Citi Prestige. All other ThankYou point earning cards can redeem points for cash back for 1 cent per point. From there, you’ll insert your bank information and confirm the total number of points that you’d like to redeem in the form of cash back.

Note: Check out our Citi ThankYou Points Complete Guide if you prefer to redeem points for travel.

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone gets into your Amazon account, they might spend your ThankYou points – causing you a headache in getting your points reinstated). The only time it is worth using points this way is when Amazon runs a coupon to save when using points: you can sometimes use 1 point to save $15 off of $50 or something like that, and in those cases it might make sense to use only 1 point, though it’s best to de-link your points from Amazon after utilizing the discount.

Manage Points

Combine Points Across Cards

If you are the primary account holder with multiple cards, you can combine ThankYou Rewards accounts. When your points are combined, they can then automatically be redeemed at the same value as your best card. For example, if one of your cards is the Strata Premier card, you will be able to transfer points to various partners even if the points were earned on a card other than the Strata Premier card.

There are some disadvantages to combining points:

- You lose the ability to pick and choose which points are used when you redeem awards.

- You lose visibility into how many points remain with each card.

The above disadvantages become important when you want to cancel a card: when you cancel a card, all points earned from that account are lost after 60 days. It’s best to downgrade to a no-fee ThankYou card rather than canceling outright. That way, your points are safe.

Share Points Across Cardholders

Citi generously allows people to transfer ThankYou points to anyone else for free. There are 2 “catches” to this:

- Shared points expire after 90 days: Make sure you have a specific near-term use in mind before transferring points.

- 100K limit: Each member may share up to 100,000 points per calendar year. Each member may receive up to 100,000 points per calendar year.

- Exception: The Custom Cash card does not have the capability to share points (but you can combine points with other cards that you have). Yes, it’s extremely weird that all other Citi ThankYou Rewards cards allow sharing points but not Custom Cash.

Why this is valuable:

- If you don’t have the Strata Premier, Strata Elite or Prestige (no longer available) card (cards in Citi’s lineup that allow a higher transfer rate to partner programs), you can move your points to a friend who has one of those cards, and then they can transfer the points to an airline or hotel program in order to book high-value awards.

- If a friend has airline elite status with one of Citi’s transfer partners with which you want to book an award, you may be better off transferring points to your friend, who can then transfer the points to the airline partner and book the award for you (to get free award changes, for example).

How to Keep Points Alive

There are several situations in which you may have Citi ThankYou Rewards points that will expire:

- Points earned by a credit card account expire 60 days after canceling that account.

- Points transferred to your account expire after 90 days.

- Points earned from some older credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citibank banking products expire 3 years after December 31 of the year in which the points were earned.

Additional considerations regarding credit card points: how to keep points alive

With most credit card points (except with some older credit cards which are no longer available), points remain alive until you cancel the card from which they were earned. Once you cancel the card, points expire after 60 days.

Combining accounts does not solve the problem. When you combine multiple ThankYou accounts, it’s natural to assume that as long as you keep any ThankYou Rewards credit card open, your points will be safe. That’s simply NOT the case. Citi keeps track of where each ThankYou point came from. If you cancel a card, the points earned on that card expire after 60 days. Period. They are NOT known to reinstate points.

The best way to preserve your ThankYou points is to keep your credit card account alive. If you don’t want an annual fee, then call to downgrade to a no-fee ThankYou card. There is a side benefit to this approach, too: Your no-fee card may be eligible for occasional lucrative retention offers.

Lifecycle

How to meet minimum spend requirements

Once you are approved for a Citi card, you generally have 3 months to meet the required spend in order to get the signup bonus. If your usual spend isn’t enough, check out our article entitled, How to Reach a Minimum Spending Requirement. Note that Mastercard (like the Strata Premier) is often accepted by a wider range of merchants and bill-pay services than Amex, and in some cases even more broadly than Visa.

Keep, cancel, or product change?

Is this card worth keeping in the long run? The main reason to keep this card around long term is as a way to transfer points to airlines and other programs. If you want to transfer ThankYou points to partners, you’ll need the Citi Strata Premier, Citi Strata Elite (or discontinued Citi Prestige). If you don’t need that capability for a while, consider downgrading to the no-fee card.

Related cards

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

This new ultra-premium card offers a solid welcome bonus, with an annual $300 hotel credit of a 2+ night stay when booked through Citi Travel®, and flexible redemption options.

Now with a signup bonus! A great complement to the Citi Strata Premier® Card.