If you’re like most people, you probably are earning a basic level of rewards through whatever credit card you got several years ago. While earning some rewards is better than earning none, there is a way that you can truly maximize the cash back and other credit card rewards that you earn.

While it is easy to get stuck in the “same old thing” you’ve always done with your credit cards, fortunately it’s fairly easy to change a few small things and earn hundreds if not thousands of dollars in credit card rewards each year.

How Much Do You Earn Right Now In Credit Card Rewards?

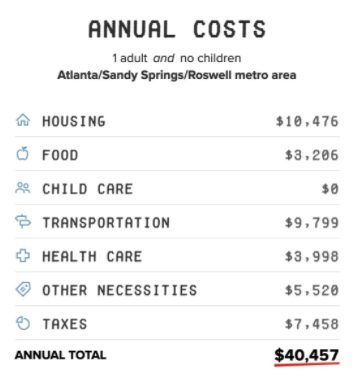

First, let’s take a look at a couple of different scenarios to see how much certain households typically earn in credit card rewards, based on an average budget. We used the family budget calculator from the Economic Policy Institute to calculate the approximate annual expenses for Atlanta, Georgia. We used Atlanta as it has an overall cost of living index of 100.2, which means it is roughly equivalent to the national average. Of course, your expenses may be higher or lower depending on where you live.

We started with the total annual costs for each scenario. Then we subtracted out housing and tax expenses, since it’s difficult to pay those expenses with a credit card (at least not for free). Then, we multiplied that net expense amount by 2% to account for the cash back rewards earned by a 2% cash back card. That gives an estimate for the amount of credit card rewards you might expect to get each year.

Scenario 1: Young Professional

A young professional should plan on expenses around $40,457 on average.

However, housing and taxes make up $17,934 of that total, giving a net annual cost amount of $22,523. Earning 2% cash back on that amount gives you an annual credit card rewards amount of $450.45.

Now let’s look at how signing up for new credit cards can affect that cash back total in this scenario. What if you got 2 new credit cards over these 12 months. With estimated net annual spending of $22,523, you have about $1,875 per month to spend. If you apply for the Citi Strata Premier® Card and the Chase Sapphire Preferred® Card, and put that spending on the two cards, you can supercharge your earnings.

This is because you’ll get a huge stack of cash from the signup bonuses on both the Citi Strata Premier Card and the Chase Sapphire Preferred Card once meeting the welcome offer — which you can easily do with your monthly spend. And the bonus cash received is in addition to the regular cash back earned by regular spend on the card. While there is a $95 annual fee for both cards, after factoring in the fee, you’ll still end up with a net earnings of well over $1,385 — depending on the current signup offer at the time.

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

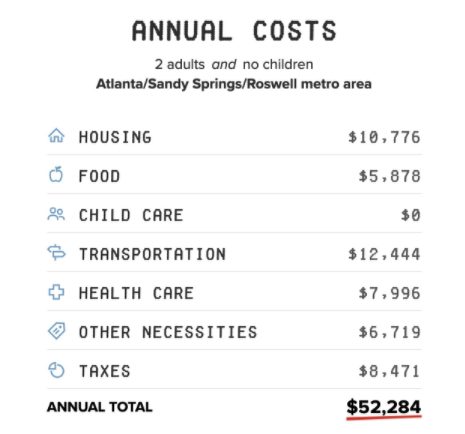

Scenario 2: Couple

A couple with no children might have approximate annual costs of $52,284.

Again, subtracting out taxes and housing costs gives a net annual cost amount of $33,037. Earning 2% cash back on that amount gives an annual rewards amount of $660.74

Now let’s look at how signing up for new credit cards can affect that cash back total in this scenario. What if you got 2 new credit cards over these 12 months. With estimated net annual spending of $33,037, you have about $2,753 per month to spend. If you use that spending to get the Citi Strata Premier and the Chase Sapphire Preferred, you can supercharge your earnings.

You’ll get a huge stack of cash from the signup bonuses on the Citi Strata Premier and from the Chase Sapphire Preferred. You’ll earn $650+ from your actual spending. There is a $95 annual fee for both cards. After factoring in the annual fee, you would get a net earnings of $1,650+!

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

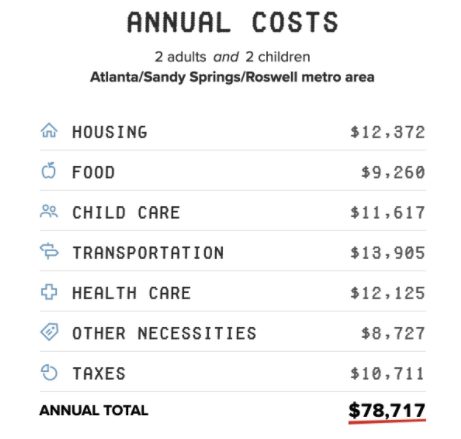

Scenario 3: Family of Four

A family with two adults and two children has gross annual expenses of $78,717.

Subtracting out taxes and housing expenses leaves a net expense amount of $55,634. That is probably a best-case scenario since very few child care costs (daycare, babysitting, school tuition) can be paid with a credit card without incurring extra fees. Still, if you are able to pay for the entire amount with a credit card giving 2% cash back, you’ll get $1,112.68 in credit card rewards each year.

Now let’s look at how signing up for new credit cards can affect that cashback total in this scenario. What if you got 2 new credit cards over these 12 months. With estimated net annual spending of $55,634, you have about $4,636 per month to spend. If you use that spending to get the Citi Strata Premier and the Chase Sapphire Preferred, you can supercharge your earnings.

You’ll get a huge stack of cash from the signup bonuses on the Citi Strata Premier and from the Chase Sapphire Preferred. You’ll still earn $1,110+ from your actual spending. There is a $95 annual fee for both cards. After factoring in the annual fees, you would get a net earnings of $2,100+!

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

Maximizing Your Cash Back Earning Through New Credit Card Signups

As you can see, the simple fact of the matter is that it’s really hard to earn more than a thousand dollars a year at most from everyday spending, unless you are spending a huge amount of money. The scenarios above represent a best-case scenario — you may earn even less if you aren’t able to put all that spending on a credit card, or if you don’t have a credit card that earns 2% cash back on all purchases.

Still, while a thousand dollars a year may sound like a decent amount, you can easily earn twice that amount or more each year without that much additional effort. The simple way to maximize your cash back rewards is by getting signup bonuses from opening new credit cards.

The CashFreely app does a few things to help you maximize your cash back earning through new credit card signups.

- First, it keeps track of all of the credit cards that you already have, along with their benefits and bonus spending categories.

- We’ll let you know how to space out your credit card applications, so you don’t hurt your credit score.

- We also maintain a list of the best credit card signup bonuses so you know which cards to sign up for

- Finally, we help you track and send you reminders for bonus spending deadlines and annual fees

Following the CashFreely process can easily be worth a thousand dollars each year, ON TOP of the rewards that you’ll still earn from your everyday spending. And the best part is that we don’t charge any fees!

The Bottom Line

It can be difficult to earn a significant amount of cash back or other credit card rewards by only using your credit card for your everyday purchases. For many people, you are looking at a few hundred dollars or maybe up to a thousand dollars in cash back each year. While that may sound like a decent return on investment, it’s possible to double the amount of rewards you get each year, or even more. The CashFreely app can help you identify what credit cards you should open, when you should open them and how to do it without hurting your credit.

Cards Mentioned in This Article

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."