In this post, we’ll talk about getting cash back credit cards may impact your credit score. I’ll give you some of the facts that bust credit score myths, and then I’ll show you my personal story.

Won’t this hurt my credit? This is the number one question people ask. Credit card rewards seems too good to be true, so people bring up this question about credit scores. Thankfully, access to one’s credit scores and credit factors are more readily available than ever, thanks to free services like Credit Karma. For the best free credit score service, we strongly recommend Experian’s free credit score service – it’s much more accurate than Credit Karma scores because it offers a true FICO score.

A recent surge in credit tools has been helping people to know the facts about credit and credit scores. The reality is that most folks who are maximizing their credit card rewards have Excellent credit scores.

Here’s why:

To have a great credit score, you have to be an overall financially responsible person. However, you have to demonstrate that quality to banks. Using cash or debit cards do not generate any history of credit usage. Therefore, these methods will not help you build any kind of credit. Someone who has used a credit card responsibly for a long time will always have a higher credit score than someone who spends with cash or debit.

Credit scores very from 500-850, and they are classified by the following terms in the ranges below:

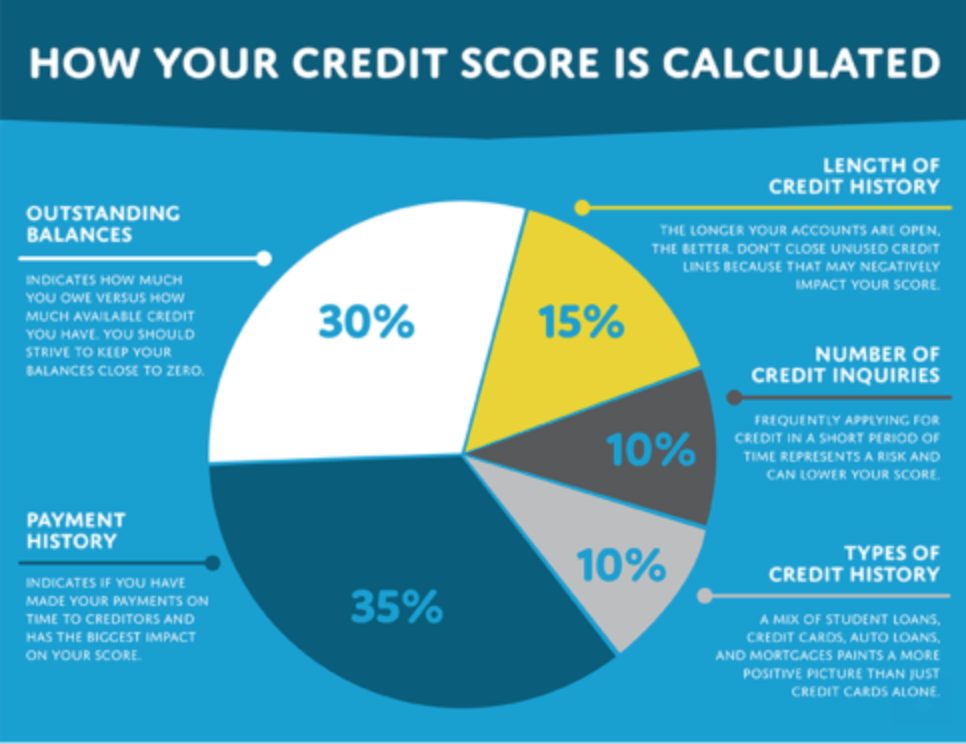

Your actual credit score is based on six main factors. It’s important to note that income is not one of them. Income can be a factor in getting a credit card application approved, but it is not a part of your credit score.

Here are the factors and their level of importance:

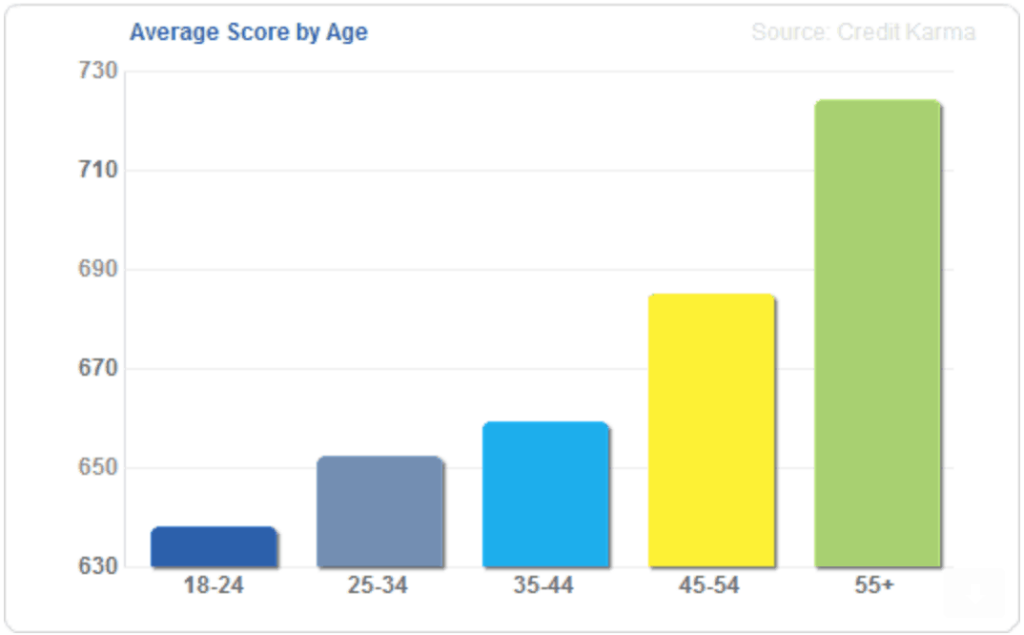

Now. Let’s take a look at the average person’s credit score by age.

You’ll see that, for someone my age, the average score is just above 650.

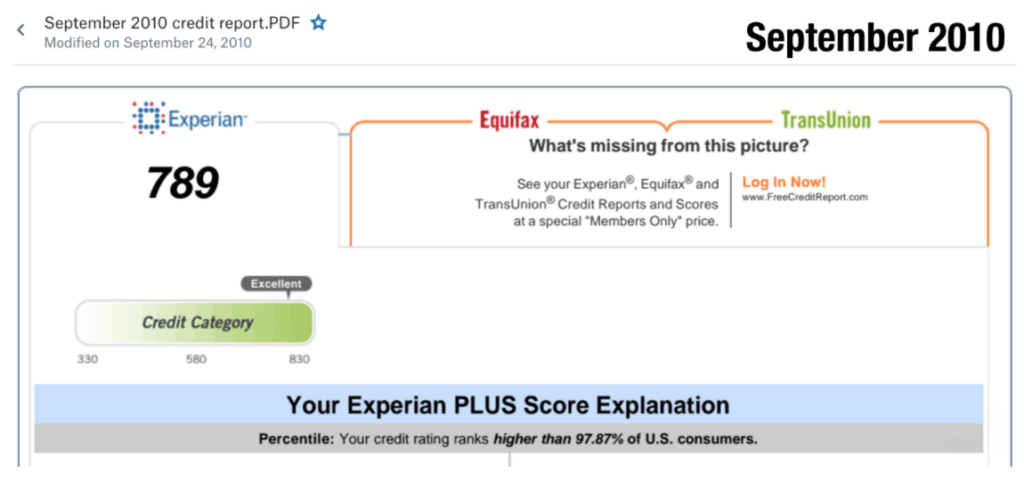

Now, here’s my story. In September 2010, I already had a mortgage and a couple credit cards that I paid off on time. My score was already pretty good at 789:

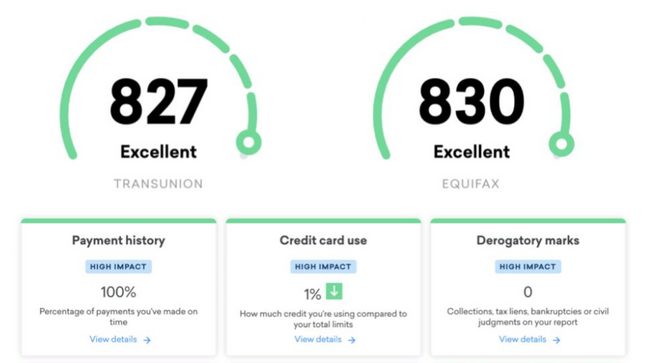

Now, after many years of applying for lots of credit cards, my score is consistently above 800.

Note that my Credit Age and Hard Inquiries are not good, but that is because I consistently open credit card accounts for the bonuses. However, going back to the chart, these categories only account for 15% and 10% of my overall score. All other areas are Excellent.

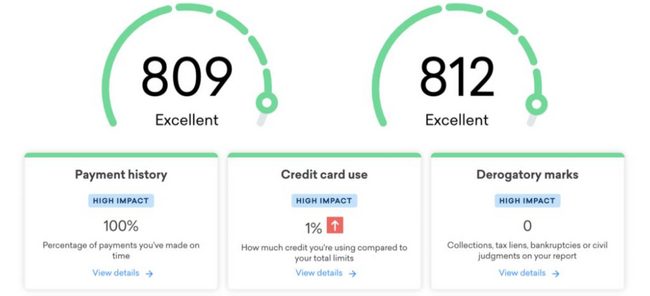

My wife only had one credit card when we got married. Here scores were a bit lower due to fewer accounts and less credit history. Here are her scores in October 2011:

After several years of applying for credit cards, here are her scores:

What’s the point? Being a credit card rewards enthusiast does not hurt your credit score, it improves it! Do a quick google search and you can find hundreds of real testimonials on this matter. The key is paying your bills on time and being a financially responsible person.

Think about this. By applying for credit cards, you never have to worry about your credit score again. Whether it’s a mortgage, car loan, line of credit, etc., you will always have the confidence that your credit score is Excellent. Sign up today, and make it happen.

Here are a few more FAQ’s on credit scores:

Should I close old accounts that I never use?

Your credit score is higher when you have a long credit history. So, closing a card you’ve had for a long time will actually lower your score because you lose that long history. Best advice is to keep the card in a drawer and forget about it.

Do I have to carry a balance to get the best credit score?

Not at all. Being in debt or carrying a card balance will lower you score. People who pay off their cards on time and have no debt have the highest scores.

Does my income affect my credit score?

Credit scores are based on several factors, and income is not one of them. Having a good income could be helpful on certain credit card applications, but your credit score is the major factor on getting approved.

Do married couples have separate credit scores?

Each individual regardless of marriage status has their own separate credit history and credit score. This means each person can get the same card (and the same bonus). You can be an “authorized user” on an account and gain a few points on your credit score, but this does not mean you are a primary account holder. This means doubling your potential bonuses!

As you can see, applying for credit cards actually IMPROVES your credit score. Already seeing a boost to your credit score? Feel free to share the good news and comment below.

Ready to start stackin’ cash and increase your credit score? Sign up for CashFreely today.