Use the following budget calculator to the average amount you could spend monthly on a credit card.

Not all expenses can go on a credit card, notably mortgage, rent, life insurance, or car payments. However, there are some services (like Plastiq) that let you pay non-traditional expenses with a credit card. These services can charge a 2-4% fee, which makes it less than ideal to be doing this on a monthly basis. However, they can be a great option if you’re in a jam and need to hit a big spending bonus. If you want to give Plastiq a try, you can use our Plastiq referral link when you sign up, and we’ll both get “fee free” dollars to use. I have found Plastiq to have good customer service. Instead of doing a lot of research, you can just chat with them about what you want to do and see if it’s a good fit.

Lastly, lots of people hit signup bonuses by paying their taxes. There are several IRS approved services that will let you pay your taxes using a credit card.

Keep in mind that you might have larger, one-time charges throughout the year, like car or homeowner’s insurance. Maybe you have a few big purchases that will be made throughout the year, too. This calculator will give you a feel for your average credit card monthly spending. After adding it all up, you may see that you can hit a credit card sign-up bonus is easier than you think.

| Education/Tuition | $ |

| Clothing | $ |

| Medical | $ |

| Car Insurance | $ |

| Home Insurance | $ |

| Life Insurance | $ |

| Health/Dental Insurance | $ |

| Home Improvement | $ |

| Phone | $ |

| Cable/TV | $ |

| Internet | $ |

| Utilities (Electricity/Gas/Water) | $ |

| Car/Gas | $ |

| Public Transportation | $ |

| Groceries | $ |

| Eating out | $ |

| Subscriptions (Online and Offline) | $ |

| Entertainment | $ |

| Memberships | $ |

| Donations | $ |

| Miscellaneous | $ |

If you are not sure how you’re paying for certain items like utilities, insurance, music subscriptions, tv/cable/streaming services, now is the time to check. If these are paid via check or debit card, you are missing out on a lot of monthly spending on credit cards that can help you hit bonuses and rack up cash back over time.

In Summary

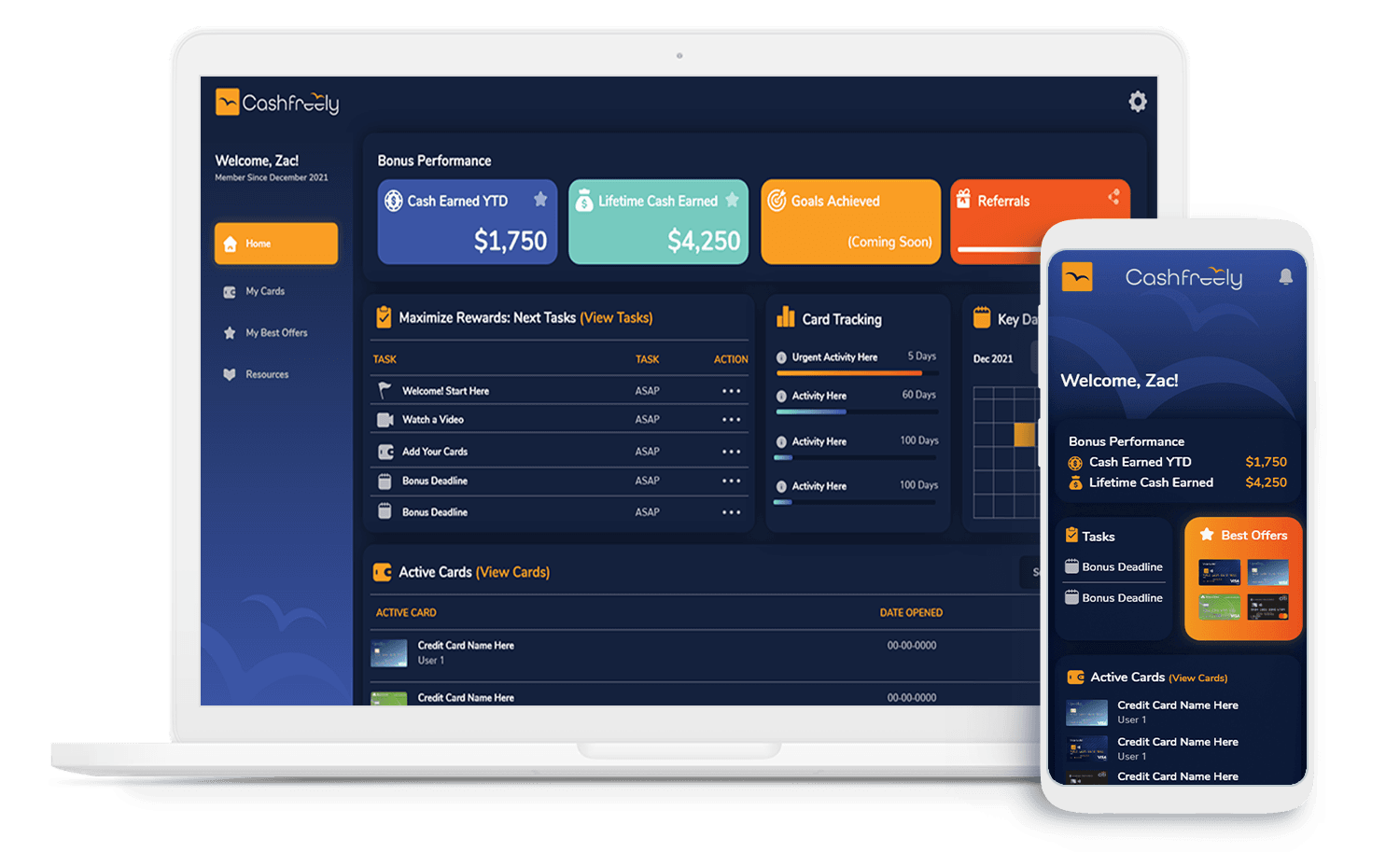

Spending requirements for bonuses have a wide range, from $1 – $5,000. Most of the best bonuses require $3,000 – $4,000 in spending. So, while there are great cards for all budgets, being able to spend $1,000-1,350 per month will put you in great shape for awesome bonuses.

Related Articles:

Hit Your Bonus – 21 Ways to Reach a Minimum Spending Requirement