It’s not widely known that couples have separate credit profiles. Most people don’t really think about it, but it’s true. With a credit card, one person is always deemed the primary and the other is the “authorized user.”

Why does this matter? Most couples get one signup bonus. They are missing out on the easiest trick! Each person can get their own card and double their signup bonus.

This is HUGE in the world of cash back.

Why is that a big deal? Because most couples have only ONE great rewards card and they get ONE large sign-up bonus. Get it? They are missing out by not doubling up!

If your partner has a good credit score, you should be doubling up. You don’t have to get the cards at the same time. You can space out your applications if you’re worried about hitting the minimum spending requirements.

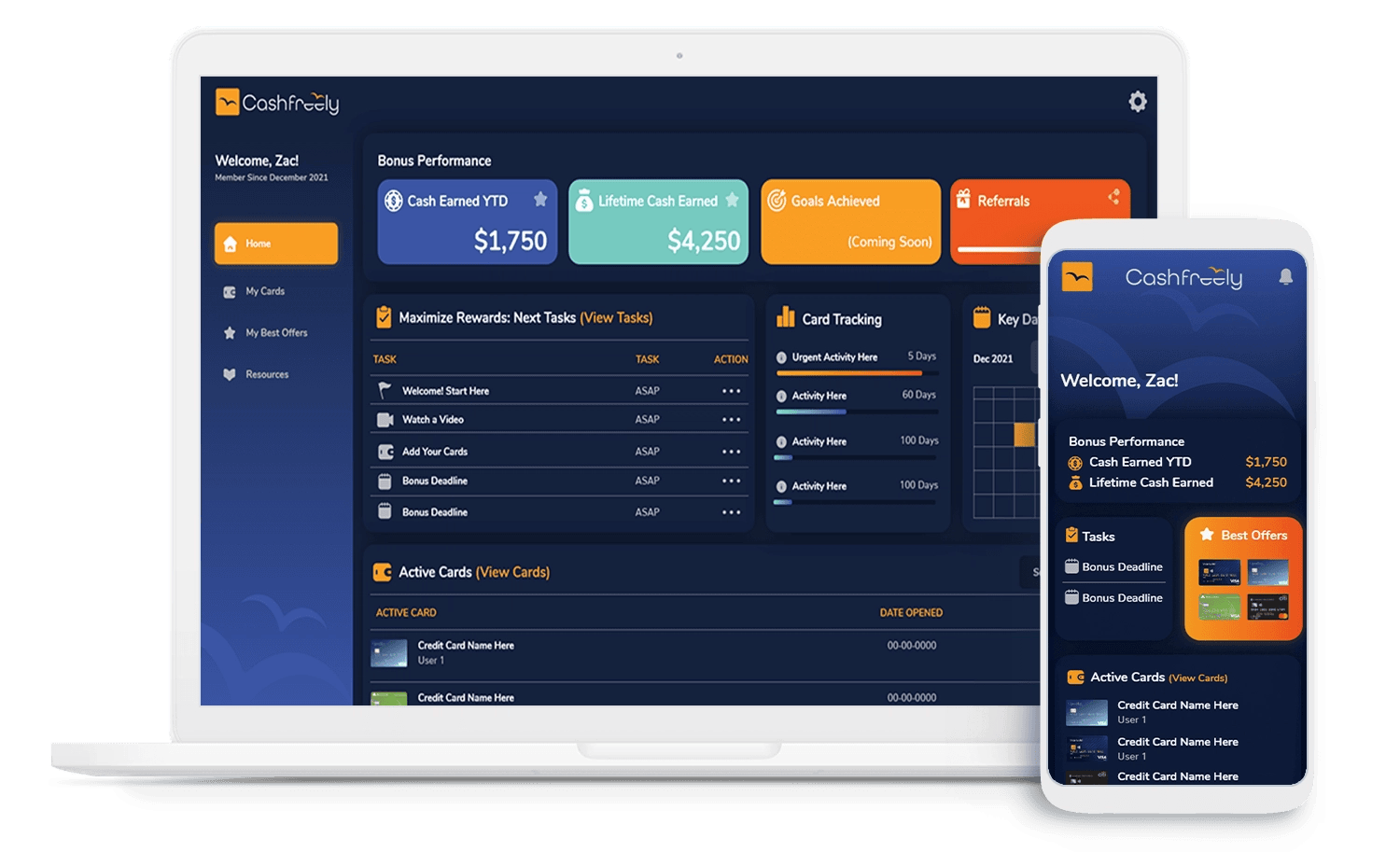

So, when you’re using CashFreely and have a second user, make sure you are checking both of your “next credit card” recommendations in the CashFreely portal. Don’t just move on to the next card on your list. This is exactly why CashFreely has a separate profile and Best Offers Recommendations for each person. Log in and check out your recommendations to see what cards you can get, and how you can double up.

This knowledge can be very handy if one person is ineligible for a new bonus on a card, or if you are both involved in a small business. For example, most beginners will quickly open a Chase Sapphire Preferred card, but they forget that their partner could get one too!

For example, if you earn 75,000 points on one bonus — worth $750 cash back — you could double that and earn $1,500 cash back value (150,000 points)!

Our #1 recommended personal card. Hands down the single best "starter card" for beginners and MVP card for overall value and flexibility. Note: New application rules as of June 2025 may affect your eligibility—click to learn more before applying.

Not married? This is still good news if you have a partner or travel companion.

Think about how you could benefit by doubling those sign-up bonuses — of course you can earn double cash back, but if you prefer travel rewards, you can think about it as double free airfare or double free nights.

Some couples are out of balance and only have one person who has cards in their name. If this is your situation, you may still be eligible for a great rewards card if you have other credit history (mortgage, car loan, etc.). If not, odds are you will need to get a starter card (with $0 annual fee) as an anchor card to hold onto and build up some credit history.

If this is the case, consider filtering your Best Offers Recommendations by “Building Credit” to get a card with better approval odds. Consider the Chase Freedom Flex card as the first card before moving on to a better travel rewards card. The Chase Freedom Flex is a simple cash back card, but it has a small sign-up bonus and can earn 5% Chase points in rotating categories.

Here’s a tip to stay organized. When my wife and I double up on the same card and get authorized user cards, we avoid confusion by using different names. I use my short name “Zac” on any authorized user cards and my full name “Zachary” on primary account cards.

Own a Small Business?

If you own a business, you could also apply this to business cards using the same EIN but a different social security number (SSN). Each bank varies with their rules, so do a little research first. I’ve outlined this with Chase regarding some of the best Chase business cards. As long as you are under 5/24, you should be good to go.

I have several friends who own their own small business. In the past month, they have doubled up on the Chase Ink Cards by having their spouse sign up for one, too. Each bonus is currently worth $750 – $900 in cash back, giving you up to $1,800 back if you double up. Note: Many business card bonuses require a lot of spending. So be careful.

Here are helpful articles on business credit cards: Am I Eligible for a Business Card? | Incredible Chase Business Card Offers | How to Apply for a Business Credit Card.

A highly recommended business card for signup bonus and 3x (3% cash back) categories on the first $150,000 spent in combined purchases. All Ink cards earn Ultimate Rewards with the option of converting to cash back.

A no-brainer, great business card with a great bonus, and great for carrying a balance. Earn unlimited 1.5% cash back on all purchases.

If you’re just getting started, remember to go slow. Being strategic is just as important as trying to amass credit card rewards. Part of the strategy is keeping it simple. By going after the best credit cards and doubling up, you are maximizing your cash back.