Taking the first step into something new is always a challenge. Think back to your first day of college, your first day of a new job, or even your first step onto an airplane. No matter how much you plan, you won’t be able to anticipate everything.

Getting started with credit card rewards is no different. However, many of our articles rely on you having good credit already established, even if you’re just getting started. But what about for those with no real credit? It can be difficult to get approved for a cash back credit card with little to no credit history.

For those of you in this situation, don’t worry. You can quickly build your credit to a point that will let you start earning valuable cash back. Do you know what the easiest way to build your credit is? With credit cards. Banks are much more likely to approve you for a credit card than almost any other type of loan.

However, some reward cards — especially the ones that offer lots of perks and come with high annual fees — are the hardest to get approved for. This means you’ll have to look at other cards to build your credit before you can target rewards credit cards. Let’s take a look at some of the easiest ways to get approved for your first credit card that will become the anchor for your credit report.

P.S. Not even sure what your credit score is? Get your free credit score.

Start a Banking Relationship

One of the easiest things you can do is to start a banking relationship with one of the major credit card issuing banks. In fact, this was how I got started.

Open a checking account with Chase, Bank of America, or any of the major national banks is a great way to get started. After a few months you will likely start receiving some pre-approved offers from the bank, sometimes these offers are even for rewards cards.

A strong banking relationship can be a great way to help you get your first credit card. While building your credit history, the banks will have a better understanding of your income and spending habits which can help them build confidence in offering credit to you even if you don’t have any credit history.

Credit Piggy-Backing

To increase the chances of getting approved for your first rewards card, you can get a quick boost to your credit history by credit piggy-backing. Credit piggy-backing works best if your parents or a close trusted friend or a family member have a credit card account that has been open for a long time, and that they do not carry a balance on. If a friend or family member falls into this category, ask them to add you as an authorized user.

This works because as an authorized user, the bank will report this particular cards credit information on your credit report as well. Since the average age of credit and on-time payments account for 50% of your credit score, this will give your credit a significant boost.

Once the information posts on your credit report, you can then apply for your own credit card. Credit piggy-backing can often boost your score enough that you can then apply for a rewards credit card of your own and start earning cash back right away.

Get a Secured Credit Card

Open A Secured Credit Card To Help Build Your Credit

If none of the above suggestions are options, the best way to start building your credit is with a secured credit card. Typically, credit cards are unsecured lines of credit — there are no assets backing up the money you’re borrowing.

A secured credit card requires you to pay a deposit in order to open it. This deposit is refundable, but it gives the bank collateral in case someone defaults on the credit card. Because of this deposit, a secured credit card is much easier to be approved for if you have low or no credit.

If you’re planning on getting started with credit cards, my recommendation is to look towards secured credit cards offered by the major bank. This lets you build your credit history and build a relationship with the card-issuing bank. Both Citi and Capital One offer secured credit cards that will help you build these relationships.

Experian Boost

Experian, one of the three credit bureaus, has a tool called Experian Boost, which can do exactly what it sounds like — boost your credit score. It is quick and easy to set up and will take into consideration payments that aren’t typically part of your credit history. If you have on-time payments with services such as utility, telecom, cable and even some streaming companies, it can potentially help you build credit.

Since on-time payment accounts for a good chunk of your FICO score — approximately 35% — showing the credit bureau that you are responsible with paying these monthly payments can help and then boost your FICO score.

You just need to make sure to pay for these bills with your checking account, savings account or credit credit card and have three consecutive months of payment (out of the last six months). And on the plus side, only on time payments are reported. So if you’ve been delinquent with payments, it won’t hurt your report.

Action Items For Your Scenario

Are you a student? If so, here are the action items you should take to anchor your credit:

- Sign up for a Credit Karma account

- Sign up for a Experian’s free credit score service to monitor your real FICO score

- Check out your current bank for any card offers you may qualify for

- Consider the Discover It Student card, or the Capital One QuicksilverOne Card

- Consider credit piggy-backing off a family member to help boost your credit score

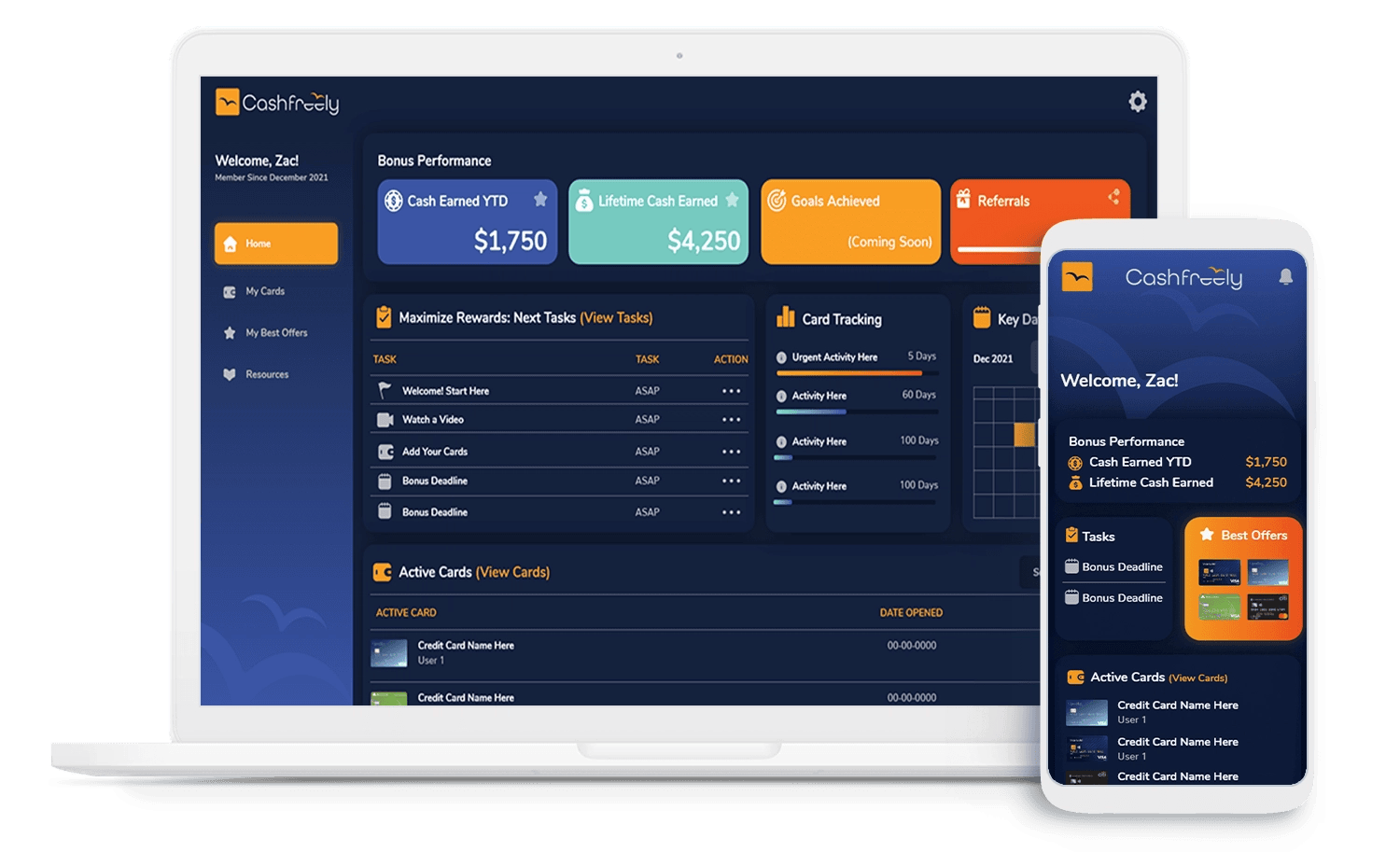

- Sign up for CashFreely to follow the best offers and keep learning – be prepared for when your credit is prime for starting in cash back rewards

Are you a working professional who needs an anchor card to build your credit before getting your first rewards credit card? If so, here are the action items you should take:

- Sign up for a free Credit Karma account to start tracking and managing your credit

- Sign up for a Experian’s free credit score service account to get the most accurate credit score

- Check out your current bank for any card offers you may qualify for

- Consider credit piggy-backing off a good friend or family member to help boost your credit score

- Open a secured credit card such as the Discover It Secured card, or the Capital One Secured card

- Sign up for CashFreely to follow the best offers and keep learning – be prepared for when your credit is prime for opening a rewards credit card

Closing Thoughts

Having little to no credit history doesn’t mean you can’t get started with credit cards, it just means you may have to take a few extra steps first. Starting relationships with the major banks, credit piggy-backing, or getting a secured credit card are great ways to start building the necessary credit history and relationships that will allow you to earn cash back in the near future.