Citi ThankYou® Points can be earned via credit card and bank account bonuses. Those points can then be transferred to various partners, used to pay for travel or merchandise, redeemed to pay bills, or converted to cash back.

Below, you’ll find everything you need to know about ThankYou Points.

Earn Points

Credit Cards

The easiest and quickest way to earn ThankYou points is through Citi credit card signup bonuses, category bonuses, and retention offers (call about once per year to ask if any offers are loaded to your cards). Below are the currently available Citi cards that earn ThankYou rewards (and that CashFreely recommends).

Personal

Now with a signup bonus! A great complement to the Citi Strata Premier® Card.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

This new ultra-premium card offers a solid welcome bonus, with an annual $300 hotel credit of a 2+ night stay when booked through Citi Travel®, and flexible redemption options.

Intriguing no-fee Strata card that can have higher value if you combine points from this card with a premium Citi account.

Business

Citi Business ThankYou Card (Only available in-branch)

Redeem Points

In general, when redeeming your ThankYou Rewards points for cash back, you’ll earn 1 cent per point earned. There are two ways in which it is possible to get more value, though: redeem points for travel or transfer points to airline partners. You can learn more about this at our sister site, Travel Freely.

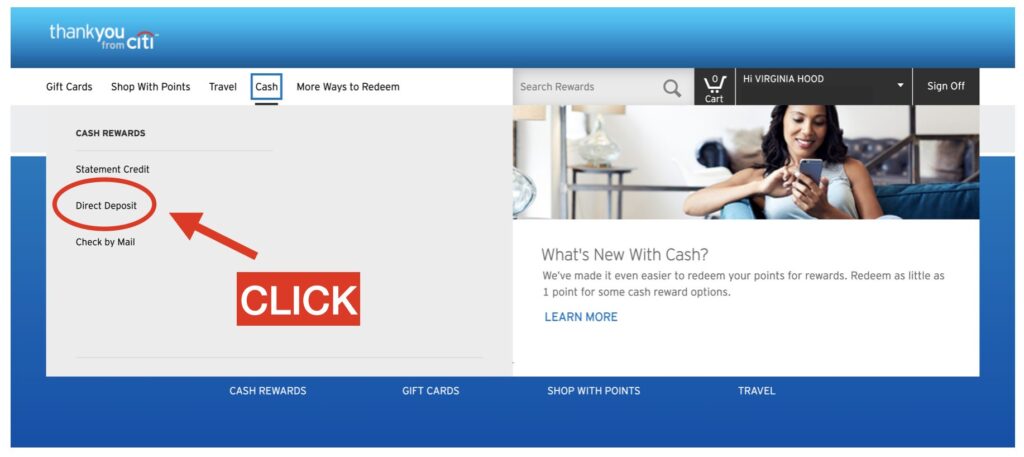

Cash back

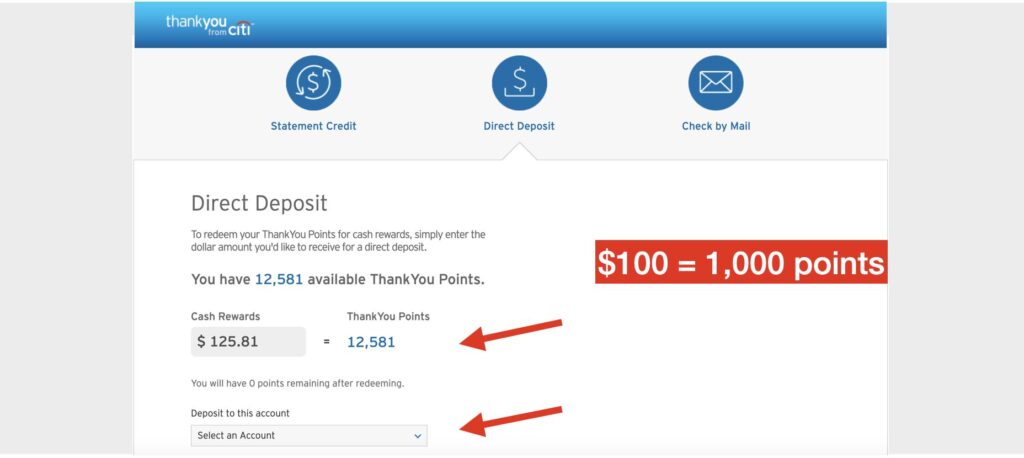

Citi ThankYou cardmembers can redeem points for 1 cent each as a statement credit. As of 8/24/25, the cash back rate for Citi Strata Premier and Citi Prestige cardholders dropped to 0.75 cents per point. All other ThankYou cards remain at 1:1 cash back ratio. The example below reflects those cards with 1:1 cash back ratio.

Under the “Cash” tab, select which form of credit you’d like.

From there, you’ll insert your bank information and confirm the total number of points that you’d like to redeem in the form of cash back.

Other Citi credit cards, such as the Citi Double Cash® Card and Citi Custom Cash® Card are pure cash back cards.

Now with a signup bonus! A great complement to the Citi Strata Premier® Card.

For those looking for the utmost simplicity when it comes to earning cash back, the Citi Double Cash Card is one of the most popular. You earn 2% cash back on every single purchase you make — 1% cash back when you make the purchase, then another 1% cash back when you pay your statement. Although, unlike the other Citi cards mentioned here, this card doesn’t offer a welcome bonus, so it won’t give you a jump start on your immediate cash back earnings.

Other ways to redeem points

Through the ThankYou Points rewards portal you can redeem points for gift cards, merchandise, charity, bill payments, and more. At most, with this approach you’ll get 1 cent per point value. One exception is that Citi occasionally offers gift cards at a discount so you may be able to get better than 1 cent per point value during a gift card sale.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value.

Manage Points

Combine and Share Points

If you are the primary account holder with multiple cards, you can combine ThankYou Rewards accounts. When your points are combined, they can then automatically be redeemed at the same value as your best card.

There are disadvantages to combining points:

- You lose the ability to pick and choose which points are used when you redeem awards.

- You lose visibility into how many points remain with each card.

The above disadvantages become important when you want to cancel a card: when you cancel a card, all points earned from that account are lost after 60 days. I recommend downgrading to a no-fee ThankYou card rather than cancelling outright. That way your points are safe.

Share Points Across Cardholders

Citi very generously allows people to transfer ThankYou points to anyone else, for free. There are two “catches” to this:

- Shared points expire after 90 days. Make sure you have a specific near-term use in mind before transferring points.

- 100K limit: Each member may share up to 100,000 points per calendar year. Each member may receive up to 100,000 points per calendar year.

Why this is valuable:

- A friend or family member with a Citi Strata Premier or Elite card can transfer points to a partner program at the highest transfer rate and book travel for you.

- If a friend has airline elite status with one of Citi’s transfer partners with which you want to book an award, you may be better off transferring points to your friend who can then transfer the points to the airline partner and book the award for you (to get free award changes, for example).

If down the line you are looking to redeem for travel, then being able to combine and share points has its perks. You can learn more about the benefits of combining and sharing points at our sister site, Travel Freely.

How to Keep Points Alive

There are several situations in which you may have Citi ThankYou Rewards points that will expire:

- Points earned by a credit card account expire 60 days after cancelling that account.

- Points transferred to your account expire after 90 days.

- Points earned from some older credit cards expire in a set amount of time after points were earned (e.g. 3 or 5 years after December 31 of the year in which the points were earned).

- Points earned from some credit cards expire if your credit card account has no purchase activity in 18 months.

- Points earned from Citi banking products expire 3 years after December 31 of the year in which the points were earned.

With most credit card points (except with some older credit cards which are no longer available), points remain alive until you cancel the card from which they were earned. Once you cancel the card, points expire after 60 days.

Combining accounts does not solve the problem. When you combine multiple ThankYou accounts, it’s natural to assume that as long as you keep any ThankYou Rewards credit card open, your points will be safe. That’s simply not the case. Citi keeps track of where each ThankYou point came from. If you cancel a card, the points earned on that card expire after 60 days. Period.

The best way to preserve your ThankYou points is to keep your credit card account alive.

Downgrading is another option. An easy way to keep your points alive and to avoid an annual fee is to simply downgrade to a no-fee card.

Important info regarding points expiration: Citi product changes result in a weird transition period quirk. Soon after product changing from one ThankYou card to another, you can log into your account and you’ll see that your points will expire within 60 days. Don’t panic. Your points won’t really expire. Wait a few more weeks and you’ll see that the points no longer have an expiration date.

The downside to downgrading to a no-fee card, of course, is that this makes your points far less valuable as they transfer to partner programs at a lesser ratio.

Bank product points: how to keep points alive

Points earned from banking products (such as checking accounts) expire 3 years after December 31 of the year in which the points were earned. Fortunately, when redeeming points combined across multiple accounts, Citi automatically uses first whichever points have the most recent expiration date. So, in general, your banking product points (which eventually expire) will be used first if you have combined accounts.

More information

Citibank’s official ThankYou Rewards FAQ can be found here.

Formerly the Citi Premier® Card, this is a new excellent rewards credit card with a solid signup bonus and 3x spending categories. Read the application rule carefully regarding "48 months."

Now with a signup bonus! A great complement to the Citi Strata Premier® Card.

This new ultra-premium card offers a solid welcome bonus, with an annual $300 hotel credit of a 2+ night stay when booked through Citi Travel®, and flexible redemption options.

Intriguing no-fee Strata card that can have higher value if you combine points from this card with a premium Citi account.

Related Articles: