Preparing taxes is no fun. No fun at all. But paying taxes doesn’t have to be painful. In fact, it can be quite rewarding to pay taxes via credit card. The key is to earn credit card rewards that more than offset tax payment fees. Here’s what you need to know…

Important due dates

- January 16, 2024: 4th quarter 2023 estimated taxes due.

- April 15, 2024: End of year taxes due for 2023.

- April 15, 2024: 1st Quarter 2024 estimated taxes due.

- June 17, 2024: 2nd Quarter 2024 estimated taxes due.

- September 16, 2024: 3rd Quarter 2024 estimated taxes due.

- January 15, 2025: 4th Quarter 2024 estimated taxes due.

Pay taxes via credit card: Key Info

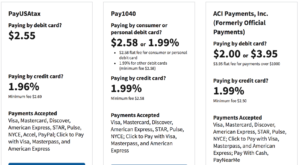

Credit card fee 1.82% to 1.98%

Here is some key information you’ll need to know about paying taxes with credit or debit cards:

The IRS maintains a list of companies that accept credit and debit cards towards tax payments. You can find the current information by clicking here. Currently, there are three separate payment processing companies on the list. At the time of this writing, debit card fees range from $2.20 to $2.55 per transaction and credit card fees range from 1.85% to 1.98%. Alternatively, you can pay taxes via the Plastiq Bill Pay service, but that will cost you more: 2.9% plus a transaction fee.

Additional Info Direct from the IRS

The IRS page that lists options for paying by credit or debit card also lists the following “Additional Information”:

- No part of the card service fee goes to IRS.

- You don’t need to send in a voucher if you pay by card.

- Card processing fees are tax deductible for business taxes.

- You must contact the card processor to cancel a card payment.

- IRS will refund any overpayment unless you owe a debt on your account.

- Your card statement will list your payment as “United States Treasury Tax Payment” and your fee as “Tax Payment Convenience Fee” or something similar.

- Federal tax lien releases can take up to 30 days after we receive full payment; liens may remain for other individuals who haven’t fully paid their portion.

- When you pay while filing your taxes through online software, different card fees apply.

Two payment limit per processor

The IRS maintains a table of frequency limits for paying taxes via credit or debit card (found here). In general, they say you can make up to two payments per tax period per type of tax payment. For example, you can make 2 payments every quarter to your quarterly estimated taxes, and you can make 2 payments every year to your annual taxes. Important: In my experience, these limits are enforced per payment processing company. That means that you can really make up to 6 payments per tax period per type of tax payment (or more if you make Plastiq bill payments as well). An IRS advisor I spoke with several years ago did not think that there would be any problem with making more than 2 payments by using different processors. Since then, I have made more than 2 payments per tax period many times and never had any issues. That is, of course, just my own personal experience. I can’t guarantee that your outcome would be the same.

Twice as many potential payments when filing jointly

If you file jointly with a partner, you can make payments in each person’s name, separately. These payments will still apply to the one overall tax return, but not always automatically. In some cases the IRS matches these payments to the combined return automatically. In other cases, people have reported the need to call the IRS to ask them to combine the payments. I recommend calling shortly after filing your annual taxes to ensure that the IRS has correctly applied both sets of payments to the same return.

Obviously if you are filing separately, you can each make your own payments without any issues.

No cash advance fees

Credit card companies do NOT charge cash advance fees when paying taxes by credit card. All three official IRS payment processors agree (via their FAQ pages) that the payment is treated as a purchase not a cash advance. You can find FAQ info here, here, and here.

Are tax payment fees deductible?

Fees are no longer deductible for personal taxes: Tax preparation fees used to be deductible when itemizing deductions for personal tax returns, but that is no longer the case.

Card processing fees are tax deductible for business taxes: This can substantially reduce your net cost of using payment services.

Tax payment history (how to see your info online)

Once you’ve made payments through online processors, Plastiq, or other means, you may want to see proof that the IRS received the amount you sent. You can view past payments by signing up here: irs.gov/payments/view-your-tax-account.

Reporting estimated payments

Estimated payments should be reported when filing your annual taxes. In my experience, if you make a mistake and forget to report some of these payments, the IRS will catch the error and refund the difference.

How to pay end of year taxes

Tell your tax preparer or tax software that you’ll pay via check. Then, browse to the appropriate tax payment site (e.g. Pay1040.com, OfficialPayments.com, PayUSAtax.com, or Plastiq.com/us-taxes) to pay your taxes. There is no need to mail in the 1040V payment voucher.

What happens if you over-pay your taxes?

Overpayments will be refunded: The IRS will refund any overpayment unless you owe a debt on your account.

Do you need to mail in payment vouchers?

No. No payment voucher required. You don’t need to send in a voucher if you pay by card.

Top reason to pay federal taxes with a credit card

Meet minimum spend requirements

If you recently signed up for new credit cards, chances are good that you have to spend thousands of dollars in order to earn the associated signup bonuses. Paying taxes is a cheap and easy way to accomplish that.

Even if the card offers 2% cash back, the profit (or slight loss) might be worth it to easily earn that welcome offer.